Yes, you can still buy a home in Canada with bad credit. Thousands of Canadians do it every year.

Having a credit score below 600 (or even below 550) is more common than you think, and it doesn’t have to stop you from getting a mortgage today. In this guide, we’ll show you exactly how to get a bad credit mortgage in Ca

If you are a Canadian homeowner with equity in your home but high-interest debt piling up, such as credit cards at 19.99%, a line of credit at 9.5%, or a car loan at 7%, you are not alone. According to Equifax, the average Canadian household now carries about $25,000 in non-mortgage debt. But there is a smarter way to

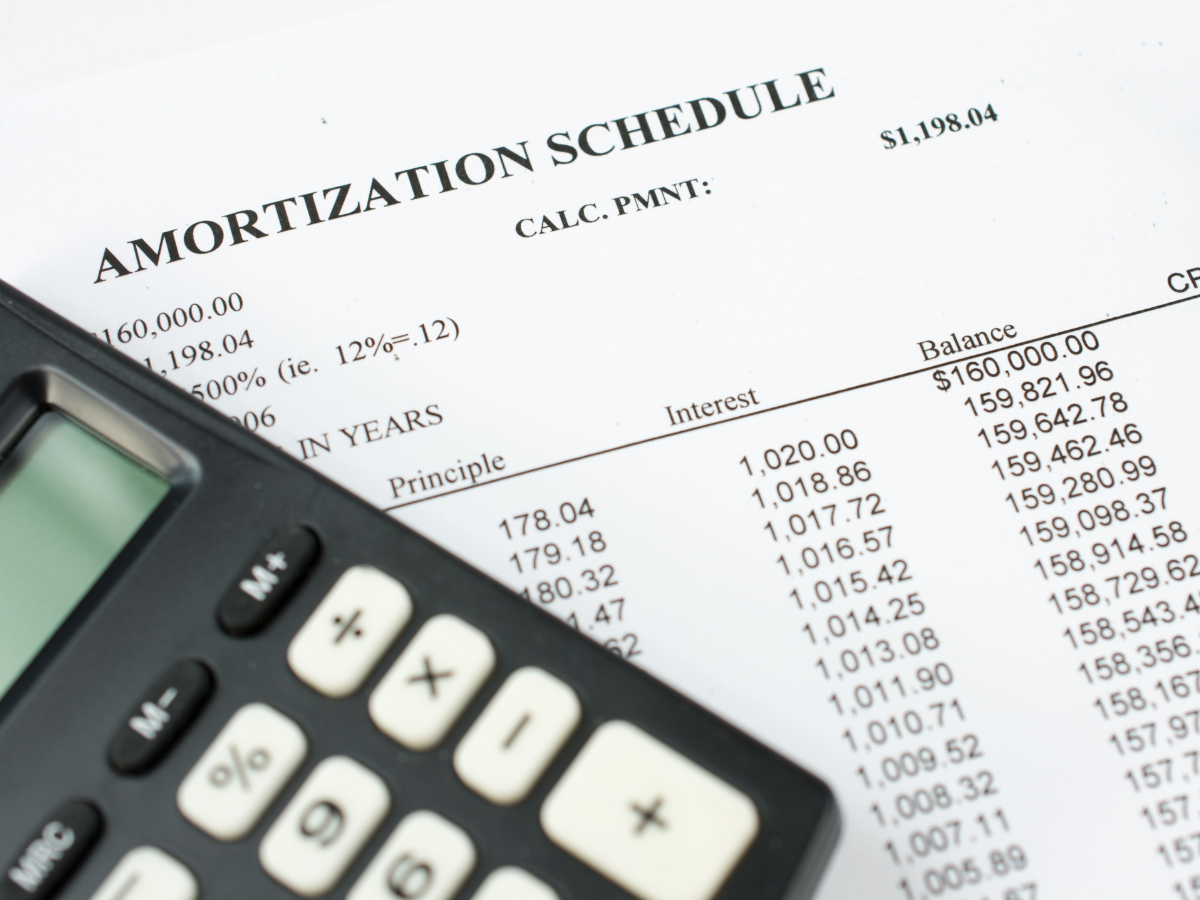

If you’re in the market for a mortgage, one key consideration is the rate type on the mortgage you choose. Will you opt for a fixed-rate mortgage or a variable-rate mortgage? Fixed rate mortgages are the most popular but does a variable-rate mortgage make sense today, now that rates have been declining?

For Canadian homeowners, the equity built up in their homes is often one of their most valuable financial assets. Whether it’s to fund renovations, consolidate debt, make new investments, or even enjoy a dream vacation, accessing this equity can open doors to new opportunities. With housing markets evolving and interest rates fluctuating, understanding your options for tapping into home equity is more important than ever. Let’s explore the main ways Canadian mortgage borrowers can access their home equity, breaking down each option with its benefits and considerations.