Beware the Mortgage Product Offering Low Upfront Rates

‘Mortgage Relief’ That Isn’t

Teaser rates are sometimes used by lenders to attract borrowers. The temptation of a low teaser rate can attractive, but buyer beware - they often come with strings attached that may eventually make the mortgage more expensive than other alternatives in the market. They can also carry unforeseen risks that are not immediately apparent. Full disclosure of how teaser rate mortgage products work is essential. The US mortgage market meltdown during the financial crisis taught us many lessons and one of them was that teaser rates are fraught with peril.

What is a Teaser Rate?

A "teaser rate" refers to an initial, artificially low interest rate offered by lenders as an incentive to attract borrowers to a specific financial product, such as a mortgage or credit card. This initial rate is often materially lower than market rates and promoted as a savings feature for the customer.

Teaser rates are typically temporary and are used during the introductory or initial period of a loan. After this initial period expires, the interest rate typically adjusts to a higher, predetermined level, which is often based on prevailing market rates, or the terms outlined in the loan agreement. The adjustment can result in a significant increase in the borrower's monthly payments, leading to what is known as "payment shock."

While these rates may initially make the financial product appear more affordable, borrowers need to carefully consider the long-term implications, real costs and potential adjustments in interest rates to make informed decisions about their financial commitments.

While teaser rates are not common in the Canadian market there is an offering out there right now that mimics the teaser rate idea that we hope does not catch on.

A Deceptive Mortgage Offer

A Canadian lender currently has a six-month insured mortgage product at a rate of 3.99%. They also offer a one-year mortgage with a rate of 4.99%. These rates look attractive, but they are deceptive.

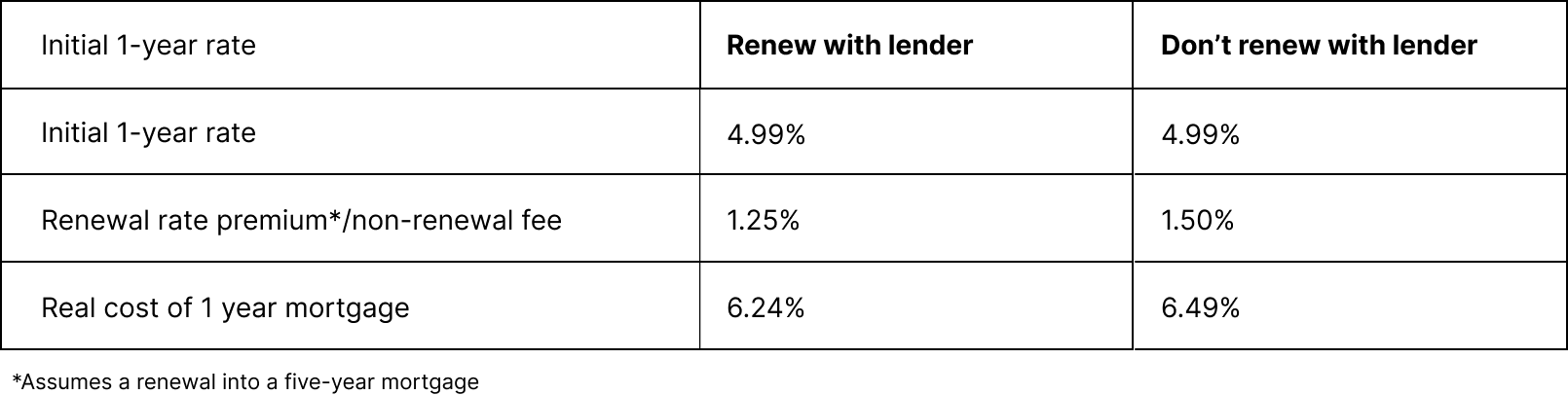

Taking a closer look at the one-year product it includes a 1.5% non-renewal fee. When the year is up, you will need a new mortgage and if you do not renew with this lender, they charge a 1.5% fee. Their mortgage lien requires you to pay this fee before they would remove the lien in favor of a new lender. Aside from the practice of charging a non-renewal fee being distasteful, and perhaps unethical, what it means is that the real rate on the one-year mortgage is 6.49% (4.99% plus 1.50%). Of course, this fee is noted in the information package they provide so it is legal, but they advertise the all-in rate for the mortgage at 4.99% when in reality it is much higher.

The lender may claim that if the client renews with them the fee is not charged so the real rate is 4.99%. This is part of the deception. They state clearly that when you renew with them, they will charge you a premium rate on the new renewal mortgage. This premium is paid to them to make up for the low rate they offered you on the one-year mortgage. In other words, it is a cost to you of the one-year mortgage. In a recent Canadian Mortgage Trends blog the lender stated that that premium is between 0.20% and 0.25%. That is 0.25% over five years, assuming you renew into the most common mortgage product, which is a five-year mortgage. The result is 1.25% of extra interest over the term of the new five-year mortgage due to the low rate one-year mortgage you chose. This too, is a cost of taking the one-year mortgage, so the real rate on that mortgage if you stay with the lender at renewal is 4.99% plus 1.25%, or 6.24%.

Either way, the real rate on this one-year, insured mortgage product is over 6%, which is higher than the rate on a five-year insured mortgage today. Yet, it is being sold to you as a 4.99% mortgage. Do not fall for a short-term mortgage teaser like this. In the end, it will cost you money.

The True Cost of This One-Year “Low Rate” Mortgage

The true cost of the mortgage is over 6%.

This is a one-year, insured mortgage costing over 6%. Compare that to today’s insured five-year mortgage rates in the range of 4.99%-5.39%. It hardly seems like a deal.

The lender may also say that taking the one-year mortgage can allow you to renew into a lower rate environment in one year. That kind of gamble on rates is reckless. Some borrowers may want to make that bet but there are no assurances that rates will be lower in a year and, even if they are, you still are paying much more than 4.99% for this one-year mortgage.

Taking the 4.99% rate might provide lower payments for the one year (it is advertised as providing short-term relief) but the reality is that it does not lower the overall cost of the mortgage. At the end of the one-year mortgage, you are being hit with a requirement to return to the lender the savings you experienced over the year.

Past U.S. Experience: Option-ARMs and Their Fallout

We write this blog about a specific product on the market in Canada that we find misleading. It is one thing to caution borrowers about a deceptive offering from a lender as a one-off incident, but we also have concern about the broader implications if this type of mortgage offering were to catch-on and be employed by others. We need only look at the mortgage market meltdown in the US during the financial crisis to see the lesson.

The US financial crisis resulted from many things but one contributor to the mortgage market meltdown was the prevalence of these teaser rate products enticing borrowers with low initial interest rates. The most infamous product was called an option-ARM. They earned the nickname ‘exploding mortgages’ once people realized the payment shock borrowers experienced after the teaser rate period was over. The issue was that the loans were much more expensive than implied by the teaser rates. The newspaper headlines at the time talked about how these products contributed to a market meltdown but on the ground what it meant was that individuals that took these products suffered financially.

Conclusion

The lesson has been learned that teaser rate products are harmful to borrowers. What we have with this product is even worse. It is dressed up as a short-term initial teaser rate, but it is not. As noted above the real rate on the mortgage is much higher. So, not only is the borrower exposed to potentially higher rates in the near future, but the product design requires the borrower to pay more than the teaser rate. The lender earns an above market rate whether you renew with them or not. Built in payment shock.

Let’s avoid that and kick these kinds of deceptive practices to the curb. Canadian borrowers deserve better. If you are looking for a mortgage, please be sure to ask about all the costs of the mortgage and read the small print. Most mortgage brokers and lenders are honest but there remain some deceptive practices, like this one, that you need to be aware of.

Frank Mortgage would never offer you a deceptive product like this. We choose to work with Canada’s best lenders that bring you competitive rates and terms so you can get your best mortgage. We are ready to help at www.frankmortgage.com or 1-888-850-1337.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.