Mortgage Affordability at Current Mortgage Rates

The markets are predicting that interest rates will decline in 2024. We believe that if there is any rate relief this year it likely will be for variable rates. They are tied to Bank of Canada rates and if the Bank cuts rates, those variable mortgage rates will decline.

Fixed rates depend on the bond market. Anyone want to hazard a guess what might happen to bond yields in 2024? We are not confident that five-year bond yields will decline materially. We do hope the trend is lower, but bond markets are difficult to predict. The best insured mortgage rates in Canada today are close to 5% for five-year fixed-rate mortgages and 6% for five-year variable-rate mortgages.

What happens if the markets are wrong again? What if rates remain where they are for most of the year. We at Frank Mortgage have been saying for some time that the real issue isn’t whether rates move a little in either direction. Rather, the issue is how long rates remain at or near these levels. Mortgage borrowers suffering through higher variable rates may not be able to hang on for much longer. Renewing mortgage borrowers are facing payment shock in 2024 as they renew into this higher rate environment. New mortgage borrowers are struggling to qualify. The persistence of higher rates could have a significant impact. It is worth evaluating mortgage affordability at today’s rates.

Is the Average Mortgage Affordable Today?

How can we evaluate the impact of rates remaining high for an extended period? First, let’s look at how affordable the average mortgage in Canada is today. Today’s best five-year fixed mortgage rates are 4.89% and 5.29%, insured and uninsured.

According to CMHC, the average mortgage size in Canada in Q3, 2023 was about $340,000. What income is required to carry a mortgage of that size?

Here is an analysis that factors in the mortgage stress test:

| Insured | Uninsured | |

|---|---|---|

| Mortgage Size | $340,000 | $340,000 |

| Down Payment | $18,000 | $85,000 |

| House Price | $358,000 | $425,000 |

| Best Mortgage Rate (as of Feb 20, 2024) | 4.89% | 5.29% |

| Stress Test Rate | 6.89% | 7.29% |

| Monthly Mortgage Payment ar Best Rate | $1,956 | $2,034 |

| Stress Mortgage Payment | $2,358 | $2,443 |

| Add: | ||

| Heating Cost | $100 | $100 |

| Est. Property Tax (1% of value) | $3,580 | $4,250 |

| Monthly Property Tax | $298 | $354 |

| Stress GDS Debt Payment | $2,756 | $2,897 |

| Income required for 39% GDS | $84,750 | $89,000 |

This analysis uses the stressed mortgage payment that a lender will use to calculate a borrower’s Gross Debt Service (GDS) ratio. The lender will take the rate on the mortgage and add 2% to meet the requirements of the mortgage stress test. Note also that this analysis does not include other debts. If a borrower has other debts like car loans, credit cards, etc. that will factor into the affordability math.

For prime, or A mortgage lenders, the GDS ratio cannot exceed 39% of the borrower’s total income. They also add an estimate of monthly heating costs and property taxes to the stressed monthly payment. Lenders use PITH (principal, interest, taxes, and heat) as the basis for the cost of the house in the GDS calculation. Absent the real numbers for a property, many lenders will use $100 per month for heating and 1% of the property value as the annual property tax bill.

Insured Mortgage - we assume the minimum 5% down payment. Using the average mortgage size of $340,000, this results in a house price of $358,000 with a 5% down payment of $18,000.

The stress tested monthly total cost for an insured mortgage is $2,756. Assuming no non-mortgage debt exists, the total household income required for a borrower to qualify for the average insured mortgage of $340,000, with a GDS ratio of 39%, is $84,810.

Uninsured Mortgage – we assume the minimum 20% down payment. Using the average mortgage size of $340,000, this results in a house price of $425,000 and a 20% down payment of $85,000.

The stressed tested monthly total cost for an uninsured mortgage is $2,897. Assuming no non-mortgage debt, the total household income required for a borrower to qualify for the average uninsured mortgage of $340,000, with a GDS ratio of 39%, is $89,144.

Can Canadians Afford a Mortgage with Today’s Interest Rates?

Using national averages like this does not accurately reflect the situation for many. It is interesting to note that the average Canadian household can afford the average mortgage today. Average Canadian household income in 2022, according to Statistics Canada was about $92,000. The affordability numbers will vary by region, where regional house price differences are significant. Toronto and Vancouver, where the average house prices are over $1 million, are not affordable for the average household.

Another way to look at this is to consider the dispersion of incomes. According to Statistics Canada, roughly 40% of Canadian households earn greater than $81,000. Looking at the affordability numbers in the analysis above, this means that over 60% of Canadian households are unable to afford the average mortgage in Canada, absent some additional support.

Mortgage Affordability for Different Income Levels

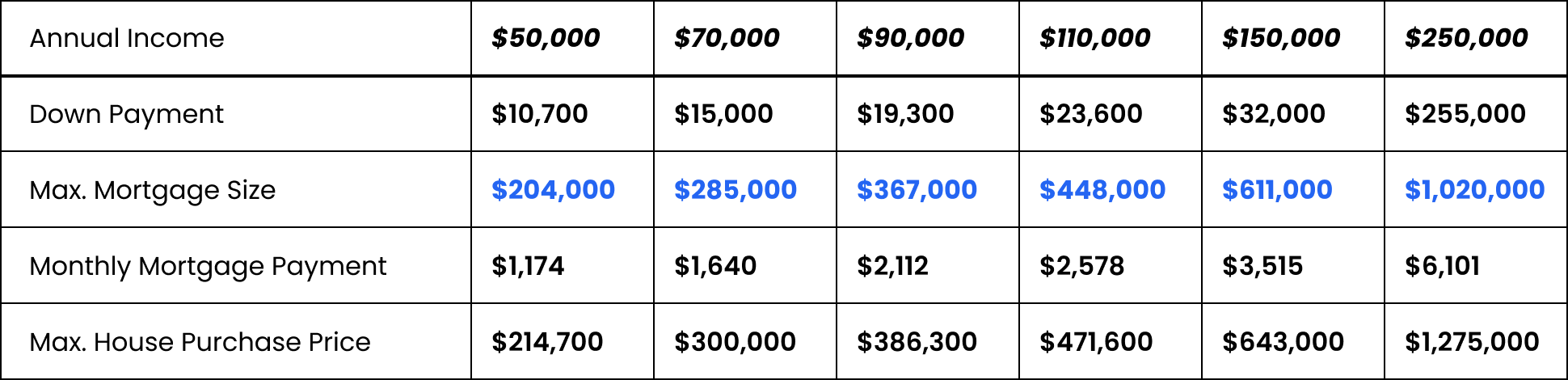

Instead of looking at national averages that are heavily influenced by major metropolitan markets, let’s look at affordability by income. What size house can a Canadian afford at different household income levels? Remember that the income that matters is total household income, meaning the income of all borrowers that will be on the mortgage. This is usually the two spouses or partners that will live in the house but can also include other co-signers.

For simplicity this analysis will assume one borrower with one salary or income. The size of your down payment significantly influences how large a home you can afford. To estimate how much mortgage you can afford we need to assume a down payment and for this analysis we are assuming you have the minimum down payment of 5% required for a CMHC-insured mortgage.

The table below looks at several scenarios:

- how much mortgage can you get with a $50,000 salary in Canada?

- how much mortgage can you get with a $70,000 salary in Canada?

- how much mortgage can you get with a $90,000 salary in Canada?

- how much mortgage can you get with a $110,000 salary in Canada?

- how much mortgage can you get with a $150,000 salary in Canada?

- how much mortgage can you get with a $250,000 salary in Canada?

- 5% down payment for all scenarios except for the $250,000 income scenario since the housing price is over $1 million. When this happens, CMHC insurance is not permitted and a minimum 20% down payment is required.

- The borrower has no other debts. If you have other debts, then the amount you would qualify for would be lower than shown here.

- 25-year amortization.

- The property is not a condo, so no condo fees included.

This shows the maximum mortgage when qualifying under prime lending criteria for various annual income levels in Canada. CMHC reports that the average mortgage size in Canada is $340,000. To qualify, this requires over $80,000 in annual income, assuming no other significant debts. The average household income in Canada is about $92,000. The good news is that the average household in Canada can still afford the average mortgage in Canada.

Of course, in larger markets like Toronto and Vancouver with higher housing prices affordability for the average household would be strained. Average house prices in Toronto and Vancouver are over $1 million. To afford the required mortgage in these markets, a household would need to have income above $250,000. Fewer than 4% of Canadian households have income above that level, according to Statistics Canada.

Can You Afford a House at Today’s Mortgage Rates?

With rates at current levels the average Canadian can afford the average mortgage. However, in larger markets with higher house prices, housing is unaffordable for the average income household.

Many current mortgage borrowers are under financial strain from their large mortgages at today’s rates. If this is you, it is important to understand what happens to your finances if rates remain at or near today’s levels. Consider this kind of analysis to determine what you can continue to afford. There are no guarantees of lower rates even though expectations are that short-term rates that are heavily influenced by the Bank of Canada will decline over the next couple of years.

If you are trying to get into the housing market, make sure you focus on affordability. Can you afford the house you want at today’s rates? Make that math work to know how much house you can afford and don’t make it depend on rates declining.

To get a check on your mortgage affordability or to look into finding great mortgage rates please contact us at Frank Mortgage – 1-800-850-1337 or at www.frankmortgage.com.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts