Monthly Market Update - August 15, 2025

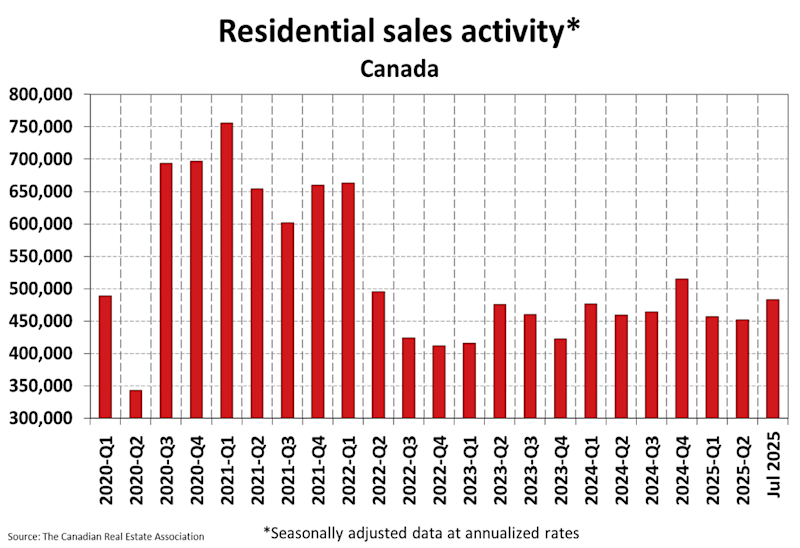

There are some signs of increasing activity in the mortgage and housing markets as the summer progresses. Increasing activity amongst prospective mortgage borrowers seems to be reflected in higher housing sales numbers. We think this demonstrates the pent-up demand that exists. If buyers and sellers can start to agree on price we should see a return to a more 'normal' level of market activity.

More homeowners are also looking at their mortgage renewal as an opportunity. Those with other debts like credit cards, lines of credit and auto loans can consolidate debts in a refinancing at renewal, pay zero penalties and lower the overall cost of servicing those debts. There is also an increase recently in mortgage switch activity. These are not refinancings, they are borrowers simply moving to a new lender, usually for better rates and/or service.

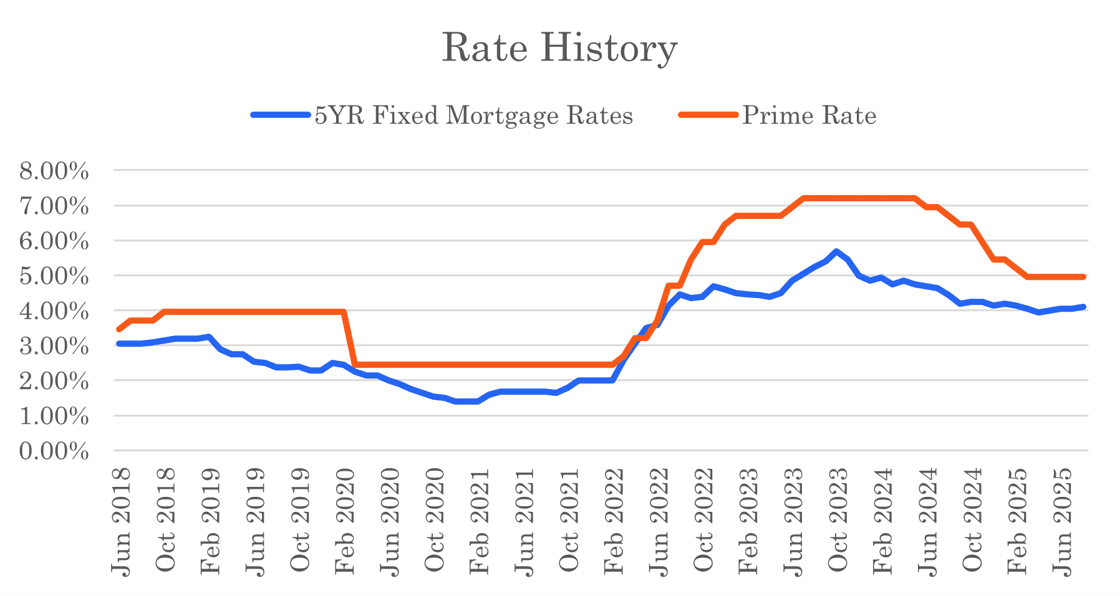

The Bank of Canada decided to hold rates steady at their July 30 rate announcement. Core inflation remains stubborn and recent economic stats remain healthy enough that they don't see an immediate need to cut. Absent more data telling them otherwise they may stand pat for a while. However, most analysts expect some softer economic data to be forthcoming and expect two more 25 bps cuts this year, with rates then levelling out through 2026.

Bond yields, however, increased in mid-July and have slowly declined since then. They remain close to 3% and all A-lenders raised their mortgage rates in late July/early August. This signals to us that fixed rates will remain in the current range of 3.75% to 4.75% for the foreseeable future.

This rate volatility highlights the benefit of a pre-approval. Those of you already holding pre-approvals at lower rates are ahead of the game now and better prepared than others. You stand to benefit financially from the free option that a pre-approval provides you.

Our best national insured, five-year fixed mortgage rate is now 4.09% and best insured, three-year fixed mortgage rate is 3.69%. This three-year rate is a short-term quick close special with one lender. Act quickly if you want to take advantage. Some regional rate specials are also available, so check with Frank Mortgage to find the best deals in your area.

Variable rates are very close to fixed rates. Our best national insured, five-year, variable mortgage rate is 4.10%.

Housing sales rose again in July on a national level. Now with a few consecutive months of increasing sales there are signs of recovery and increased activity.

Mortgage Market

- The prime rate is 4.95%

- The best nationally advertised mortgage rates are in the table below:

- The five year government bond yield is 2.99% today, 0.14% lower than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates remain steady

- Fixed mortgage rates are higher

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. 3-year mortgage rates are comparable to 5-year rates.

- Bank of Canada holds interest rate at 2.75% as economy shows resilience in the face of tariffs - CBC

- 75% of economists predict BoC cutting rates twice more in 2025, then holding rates steady through 2026 - Reuters

- Economists at BNS and RBC now say the BoC will keep their benchmark rate at 2.75% through the end of 2025 - MPC Mag

- Fixed mortgage rates creep higher as bond yields rise - Canadian Mortgage Trends

- U.S. core inflation back above 3% - Mortgagelogiq-news

- The CRA is moving closer to implementing a digital tool that would allow mortgage lenders to verify borrower income directly - MPC Mag

- Can you retire with a mortgage? More Canadians are saying yes - Canadian Mortgage Trends

- Mortgage Professionals Canada Survey Results:

- 70% of Canadians who bought a home in the last two years said they couldn't have done it without help for their down payment

- Two-thirds of respondents said they are likely to use a mortgage broker

- 20% of those facing renewal are anxious about higher payments

- Fixed rate mortgages remain most popular, preferred by 68% of respondents

- 34% are concerned about mortgage fraud and 57% support the CRA helping the industry confirm income directly

- 60% of mortgagors renewing in 2025 and 2026 will see increased payments - Bank of Canada

- Inflation in Canada rose to 1.9% in June.

Housing Market

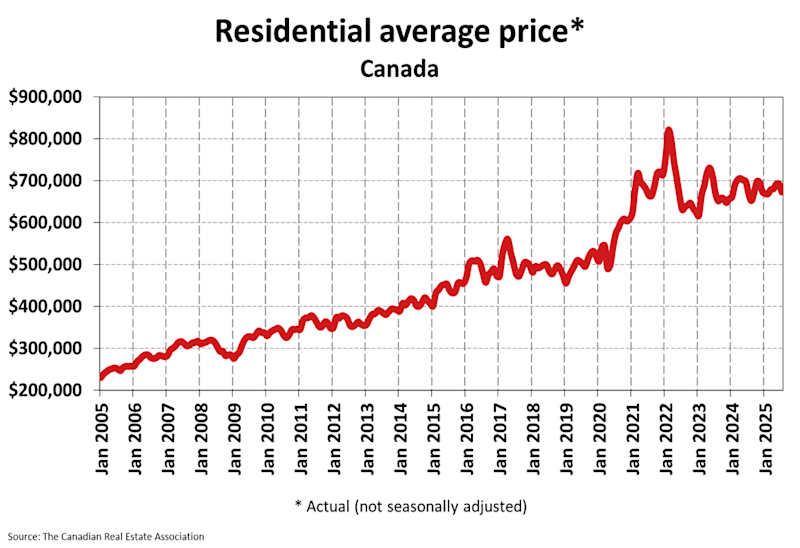

The MLS Home Price Index (HPI) was unchanged month-over-month in July 2025. The actual (not seasonally adjusted) national average sale price rose 0.6% year-over-year. The actual national average home price was $672,784 at the end of July 2025.

Housing Sales increased by 3.8% month-over-month in July 2025. Actual (not seasonally adjusted) sales were up 6.6% versus the prior year, July 2024.

Housing Market Headlines

- New listing activity was up slightly in July by 0.1% month-over-month - CREA

- Nationally, there were 4.4 months of housing inventory for sale at the end of July 2025, below the long-term average of 5 months - CREA

- With sales posting a fourth consecutive increase in July, and almost 4% at that, the long-anticipated post-inflation crisis pickup in housing seems to have finally arrived - CREA

- Activity continues to pick up through the transition from the spring to the summer market, which is the opposite of a normal year, but this has not been a normal year - CREA

- Detached housing values in Vancouver's and Toronto's most affordable price points edge upward as buyers cautiously return to inventory-rich markets - RE/MAX

- Greater Vancouver homebuyers taking the summer off in tepid market - Business Intelligence

- RE/MAX report finds rebound in some pockets of BC real estate market - Global News

- Alberta outpaces rest of Canada in 2025 housing starts - City News

- Flood of new supply freezes Calgary home price growth - Real Estate Magazine

- Regina's housing market remains steady - CTV News

- Toronto condo prices hit four year low - TREBB

- Greater Toronto housing market sees best July in four years - TREBB

- Eliminating Provincial trade barriers would add 30K annual housing starts - CMHC

- Canada's housing slump expected to extend into 2026 - Oxford Economics

- Housing starts were up 4% in July - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts