Monthly Market Update - May 15, 2024

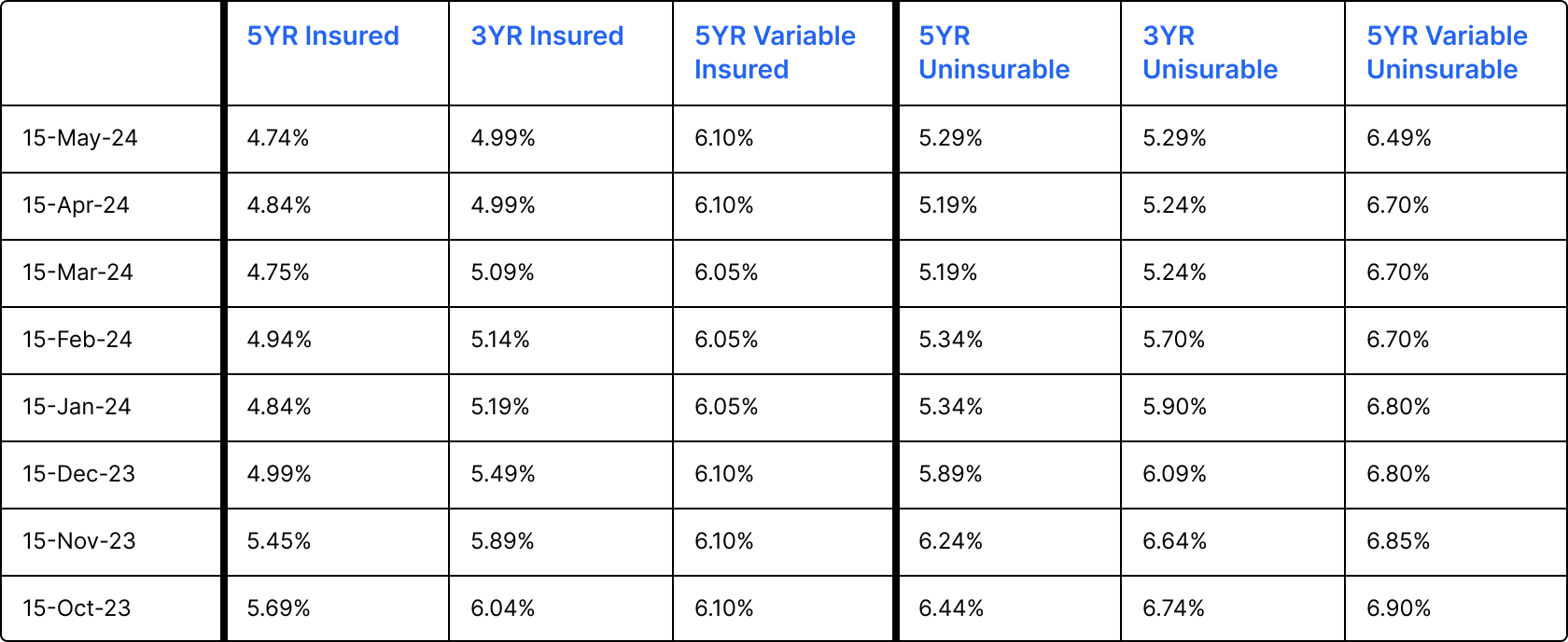

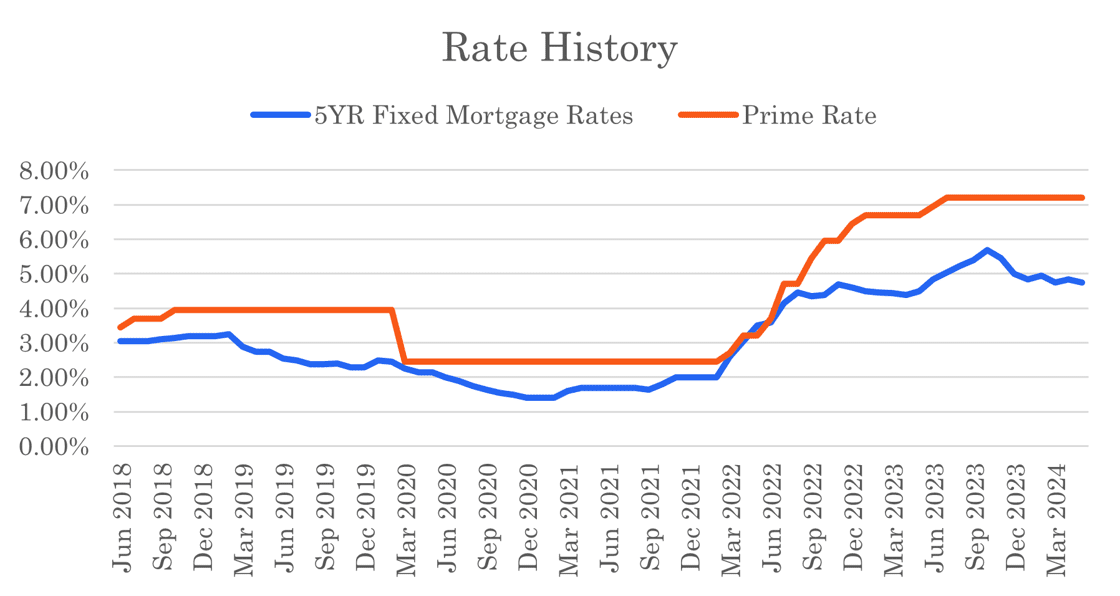

Mortgage rates have remained steady over the past month despite some variability in bond yields. Variable rates at most lenders are unchanged, but one lender had a temporary and aggressive uninsured variable-rate promotion of 6.19% that expired on May 14. Hopefully, we will see more offers like that. Overall, the rate environment has not changed much since last month but some lenders are being more aggressive in the spring market so there are opportunities to find rate specials if you deal with a good broker like Frank Mortgage.

There are no Bank of Canada announcements in May 2024. The next announcement is scheduled for June 5. The financial markets currently place a less than 50% chance on a rate cut in June.

The past month has seen an increase in mortgage enquiries and pre-approval activity. Some sidelined buyers appear to be returning to the market. Homes for-sale inventory is up in major markets like Toronto, particularly in the condo market where sales have been declining.

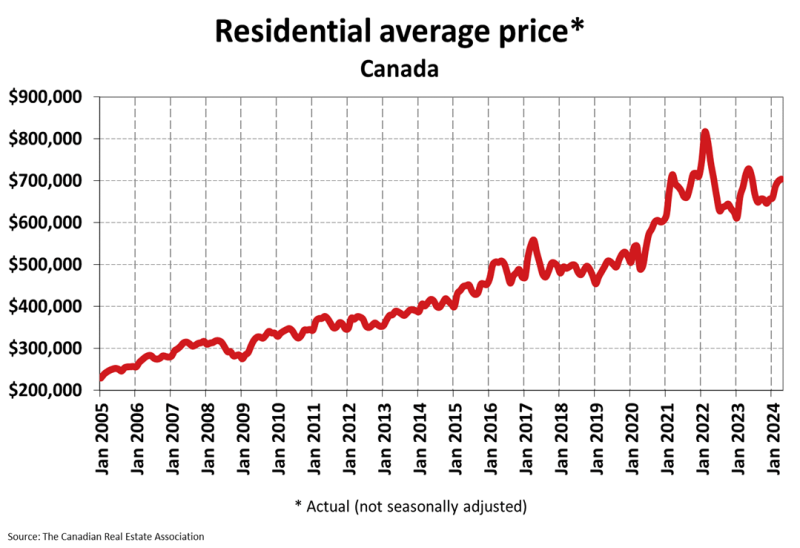

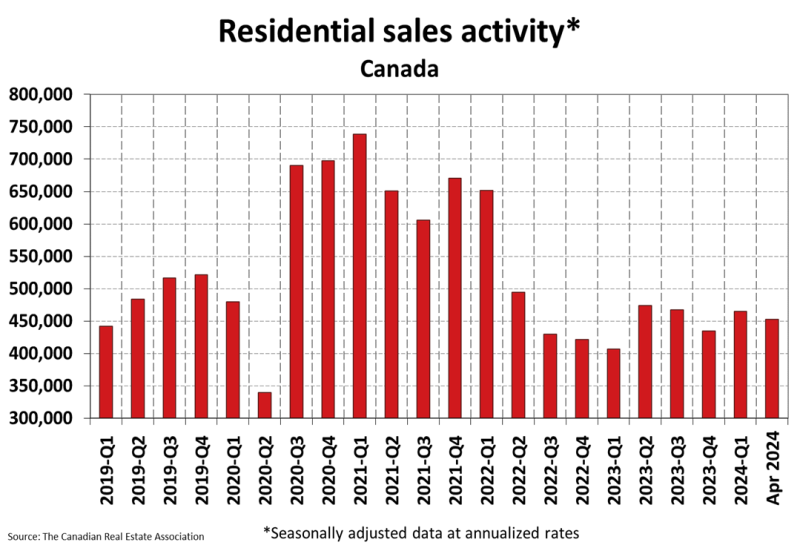

Housing prices are unchanged nationally but have declined in some markets. The strongest markets showing house price appreciation are Edmonton, Calgary and Saskatoon. Housing sales were down slightly month-over-month in April. Sales activity remains below the 10 year average.

Five-year bond yields have fluctuated and are down slightly compared to last month. Five-year fixed mortgage rates have not changed dramatically month-over-month but a couple lenders have some new, lower insured mortgage rate offers available. The lowest insured, fixed mortgage rate is now 4.74%.

Variable rates remain high and will stay there until we see the anticipated rate reductions by the Bank of Canada.

Mortgage Market

- The prime rate remains at 7.20%

- Bond yields have changed little, perhaps waiting for further indications from the Bank of Canada on a June or July rate cut. Five-year insured mortgage rates below 5% remain available with multiple lenders

- The five year government bond yield is 3.65% today, which is 0.13% lower than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Five-year fixed mortgage rates did not change materially in the past month

- Fixed mortgage rates are more than 1% lower than variable mortgage rates

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- The BoC has made it clear that “rate cuts will be gradual” as it remains focused on meeting inflation targets - BMO

- Long-term mortgage products should become much more widely available in Canada to help homeowners avoid crippling "payment shocks." - Desjardins

- Bank of Canada warns of steep jump in mortgage payments upon mortgage renewal - Globe & Mail

- CMHC released the results of its 2024 Mortgage Consumer Survey. Key results include:

- 13% of potential buyers have delayed their purchase decision due to interest rates

- First-time buyers and newcomers were most likely to delay their purchase

- It took an average of 4.2 years for buyers to save for their down payment

- 30% of buyers received a gift of funds to help with their down payment

- 12% of respondents shared the home purchase with someone other than their spouse/partner

- Mortgage refinancings were done most often to fund renovations (33%) and to consolidate debt (23%)

- New mortgages in the past year were 62% renewers, 19% refinancers and 18% homebuyers. The latter group was down from 23% the prior year.

- Mortgage stress tests cause more harm than good - Globe & Mail

- Inflation in Canada slowed to 2.9% in March. The data for April will be released on May 21, 2024.

Housing Market

The MLS Home Price Index (HPI) was unchanged month-over-month in April 2024. The actual (not seasonally adjusted) national average sale price was down 1.8% year-over-year. The actual national average home price was $703,446 at the end of April 2024.

Housing Sales declined by 1.7% month-over-month in April 2024. Actual (not seasonally adjusted) sales were up by 10.1% over the prior year, April 2023.

Housing Market Headlines

- New listing activity in April increase by 2.8% month-over-month - CREA

- Nationally, there were 4.2 months of housing inventory for sale at the end of April 2024. This is the highest level since the beginning of the pandemic but below the long-term average of closer to five months - CREA

- “This spring thus far has a healthier number of properties to choose from but less enthusiasm on the demand side.” - CREA

- Slower sales amid more new listings resulted in a 6.5% jump in the overall number of properties on the market, reaching its highest level since just before the onset of the COVID-19 pandemic. - CREA

- Homebuyers find bargaining power in spring housing market - Global News

- 29% of Canadians plan to buy a home in the next two years, up from 22% last year - RBC

- 65% of newcomers to Canada plan to purchase a home within the next two years - RBC

- Recreational property prices expected to rise by 6.8% in 2024 - RE/MAX

- 72% of aspiring homeowners waiting for interest rates to drop - BMO Survey

- "Mortgage rates are still high, and it remains difficult for a lot of people to break into the market but, for those who can, it’s the first spring market in some time where they can shop around, take their time and exercise some bargaining power. - CREA

- Housing starts down in April - CMHC

- Home ownership feels out of reach for 76% of Canadians who don't own property - CIBC

- Canada increased the inclusion rate on capital gains for secondary homes to 66.7%

- New Canadian mortgage rules to have little impact on housing - BMO

Do you have questions about a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.