Monthly Market Update - May 15, 2025

It's remarkable how much influence one individual can have on global markets. These days, it's hard to consider an investment decision or market outlook wthout factoring in the actions of the U.S. President. While we remain optimistic about the road ahead, we look forward to seeing the current wave of global realignment and tariff discussions evolve into more stable, long-term solutions.

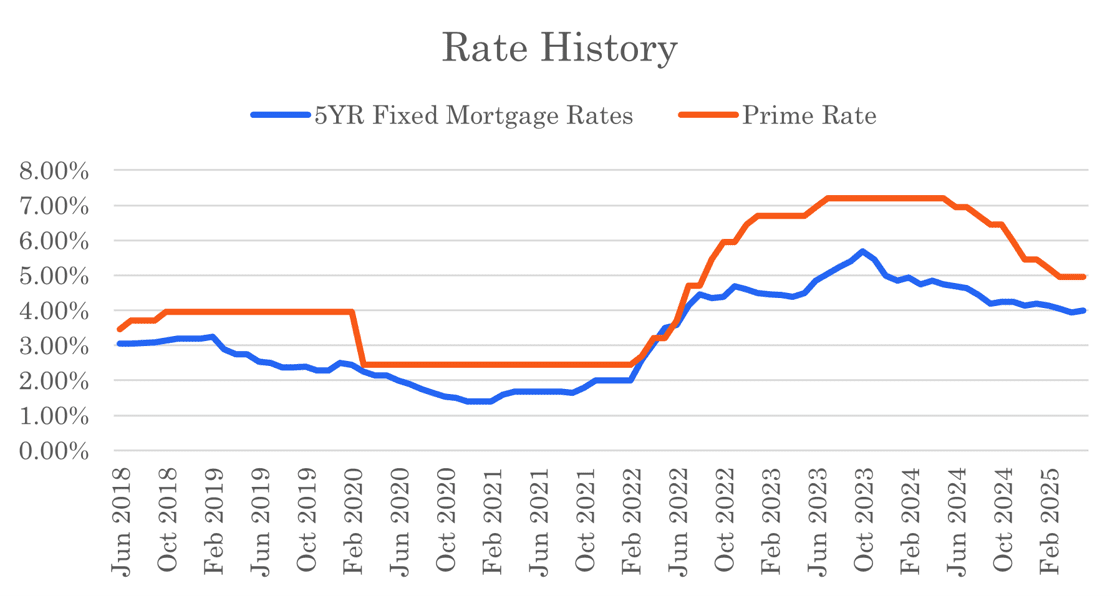

Bond yields have bounced around but are only higher by about 0.05% since this time last month. Not a significant difference, but further evidence that fixed rates are near a bottom.

Variable rates have risen slightly. This is not because the Bank of Canada changed rates - they didn't, they held rates steady on April 16. This is because many lenders have adjusted their margins on variable-rate mortgages.

Analysts are split on whether the Bank of Canada will cut rates again in June, but there is a stronger consensus that a cut is coming by July.

This rate action and the overall uncertainty that persists today has led to an increase in fixed mortgage rates. The best rates are back near 4%, with most lenders now above 4%. We continue to believe that fixed mortgage rates will bounce around within a range for the balance of the year, likely between 3.5% and 4.5%.

Our best national insured, five-year fixed mortgage rate is now 3.99% and best insured, three-year fixed mortgage rate is also 3.99%.

Variable mortgage rates will drop again upon the next Bank of Canada cut. Any signals of Canadian economic weakness may lead to those cuts coming sooner rather than later.

Variable rates are only slightly higher than fixed rates. One more rate cut and they will finally fall below fixed rates once again. Our best national insured, five-year, variable mortgage rate is 4.15%.

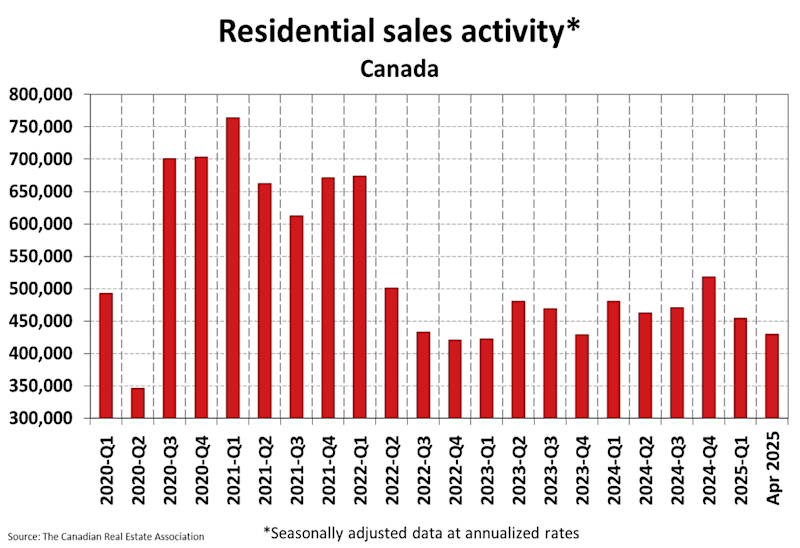

Housing sales were flat in April and inventories are climbing. The data is not positive. This might depend on your view, though. We are now in a buyers market in many major markets and if you are looking to enter the market, your chances of finding an affordable price are improving.

Mortgage Market

- The prime rate is 4.95%

- The best nationally advertised mortgage rates are in the table below:

- The five year government bond yield is 2.75% today, only 0.05% higher than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates are up slightly as lenders adjust their margins

- Fixed mortgage rates are moving up

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. The yield curve is flattening, however, and now 3-year mortgage rates are comparable to 5-year rates.

- Fixed mortgage rates are creeping up and variable-rate discounts are shrinking too - Canadian Mortgage Trends

- US tariffs are weighing on the Canadian economy, increasing the likelihood of a rate cut - BMO

- Expect further rate cuts from both the Bank of Canada and the Federal Reserve - RBC

- The big banks are divided on how much the Bank of Canada will cut this year and next - Canadian Mortgage Trends

- After briefly dipping below 4%, most five-year fixed mortgage rates are back above the 4% mark, and could stay elevated for the foreseeable future - Canadian Mortgage Trends

- Five-year and three-year fixed mortgages notably have very similar rates right now - Globe & Mail

- One-third of Canadians say saving for a down payment is the main barrier for entering the housing market - BNN Bloomberg

- Mortgage renewals surge, as home purchases decline - MPA

- Ontario regulator warns public about dealing with unlicensed mortgage entities - CMP

- Inflation in Canada slowed to 2.3% in March.

Housing Market

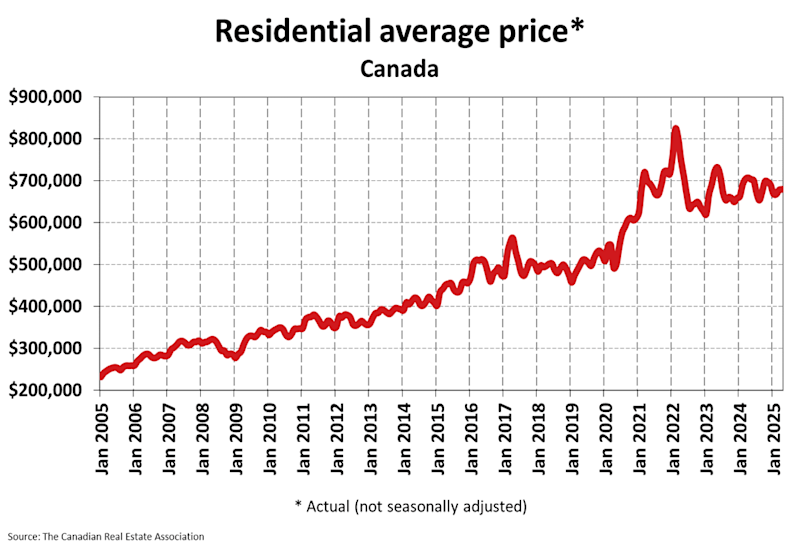

The MLS Home Price Index (HPI) declined 1.2% month-over-month in April 2025. The actual (not seasonally adjusted) national average sale price fell 3.6% year-over-year. The actual national average home price was $679,866 at the end of April 2025.

Housing Sales were unchanged (down 0.1%) month-over-month in April 2025. Actual (not seasonally adjusted) sales were down 9.8% versus the prior year, April 2024.

Housing Market Headlines

- New listing activity in April fell 1% month-over-month - CREA

- Nationally, there were 5.1 months of housing inventory for sale at the end of April 2025, inline with the long-term average of 5 months - CREA

- At this point, the 2025 Canadian housing story would best be described as a return to the quiet markets we've experienced since 2022, with tariff uncertainty taking the place of high interest rates in keeping buyers on the sidelines - CREA

- The number of homes for sale across Canada has almost returned to normal, but that is the result of higher inventories in B.C. and Ontario, and tighter inventories everywhere else - CREA

- Housing markets are slowing across Canada, but that presents some of the best purchasing opportunities for buyers seen in decades - BMO

- Homes sales are expected to remain relatively flat compared to 2024 - CREA

- 67% of prospective homebuyers are delaying their purchase until interest rates decline - BMO

- Home sellers are pricing too high and not listening to the market - Realtor.com

- In April, 66% of homes sold in Toronto went for less than the listing price, the highest % for April since 2013 - BNN Bloomberg

- Record number of new condos remain unsold in Vancouver - CMP

- Calgary home sales decline 22.4% year-over-year - CREB

- Edmonton real estate market continues to grow - Edmonton Journal

- Sales up, listings down in Manitoba - CTV News

- New condo sales in GTHA plunge to lowest level since 1995 - Urbanation

- GTA home sales plunged 23.3% compared to April 2024 and a flood of new listings saw prices dip - TRREB

- Prices up but sales activity slightly decreasing in Halifax - Wowa.ca

- Carney set to further limit immigration to ease housing pressures - NewsBreak

- Ontario to table bill to speed up home building - CBC

- Homebuyers see rising inventory, further price declines to come - Globe & Mail

- 1 in 4 potential buyers waiting for rates to drop to 3% - Real Estate News

- Canadian cottage buyers on the sideline for now amidst tariff concerns - RE/MAX

- Rising recession concerns among Canadians sidelining prospective homebuyers - BMO

- Housing starts increased 2.4% in April - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts