Monthly Market Update - November 17, 2025

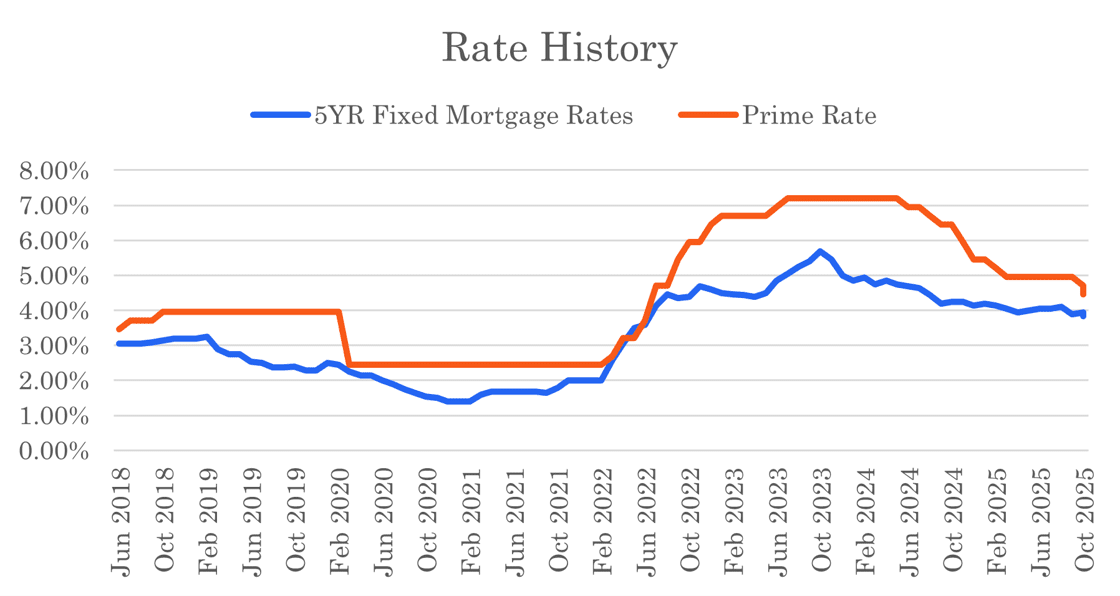

Mortgage rates range from the high-3% to mid-4% range for most terms, both fixed and variable. These rates are now comparable to the rates we had pre-COVID and are normal rates when compared to history. Homebuyers and mortgage borrowers who paused activity in the past two years might want to have their mortgage broker run the numbers for them. With housing prices declining in many markets and rates now at healthy levels again, the numbers might surprise you.

Take these stats for instance. The best nationally advertised five-year fixed rate for an insured mortgage is 3.84%. Two years ago that same rate was 5.79%. These lower rates present a material improvement in affordability as shown below. For this example we assume a $700,000 mortgage, a 25 year amortization and $200,000 of household income:

| 5-Yr Insured Rate | Monthly Payment | Buying Power | |

|---|---|---|---|

| Oct 2023 | 5.79% | $4,391 | $752,831 |

| Nov 2025 | 3.84% | $3,621 | $914,755 |

The monthly payment saving of over $700 adds up to over $40,000 over a five year mortgage. Buying power for homebuyers has increased materially - by over 20% in just the past two years. Not only can today's low rates benefit homebuyers but there can also be savings for existing borrowers looking to refinance out of a high rate mortgage.

The Bank of Canada reduced their overnight target rate by 0.25% at their October 29 announcement. This is the second straight cut and was largely expected. However, the Bank also implied that they do not anticipate making any more rate cuts in the near term. Their next rate announcement is on Dec 10th and the bond market is currently pricing in an 80% probability of the Bank leaving rates unchanged.

Bond yields have risen slightly since last month, up 0.15%. Despite this, fixed mortgage rates declined in late October. Variable mortgage rates also declined due to the rate cut by the Bank of Canada.

We anticipate that rates will stabilize near current levels for the near term. There may be some variations as bond yields tend to fluctuate and some lenders might offer some rate specials from time-to-time. Mortgage borrowers should get used to rates at this level. Market pundits are split on whether rates may decline or rise in 2026. Absent a consensus one way or the other, predicting the direction of rates is difficult.

We have our fingers crossed that some lenders will remain aggressive into the winter months. The best way to know which lenders have good offers and when they are being offered is to work with an experienced mortgage broker. Check with Frank Mortgage to find out where the best rates can be found to maximize your mortgage outcome and have us run the numbers for you for free.

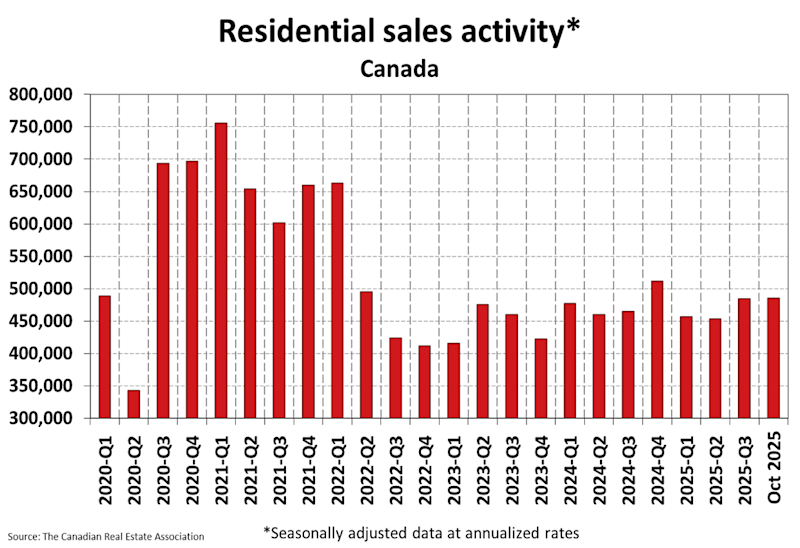

Housing sales were up in October on a national level month-over-month, confirming anecdotal evidence from market participants that activity was picking up.

Mortgage Market

- The prime rate is 4.45%

- The best nationally advertised mortgage rates are in the table below. There are often regional rates that are better, so check with your mortgage broker.

- The five year government bond yield is 2.75% today, 0.15% higher than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates have declined and will remain unchanged going forward if the Bank of Canada holds rates steady.

- Fixed mortgage rates are down slightly at most lenders

- Most economists expect the Bank of Canada to keep rates unchanged on Dec 10

- BoC to pause rate cuts in December - RBC

- Hopes of big BoC cuts are fading fast - CMP

- Scotiabank says the Bank of Canada's next move will be a rate hike - Canadian Mortgage Trends

- All told, the Bank of Canada has served up nine rate cuts - 275 basis points of relief - since June of last year - Financial Post

- Real estate experts happy with mortgage rates after BoC announcement- CTV News

- Canadians gravitating toward longer-term fixed-rate mortgages amid economic turmoil - CMP

- Early cracks in household credit hint at mortgage stress by 2026 - CIBC

- 56% of insured mortgages in 2025 opted for a 30-year amortization - Canada Guaranty

- Donald Trump's 50 year mortgage plan is being panned. It also wouldn't fly in Canada - The Globe & Mail

- Inflation in Canada dropped to 2.2% in October

Housing Market

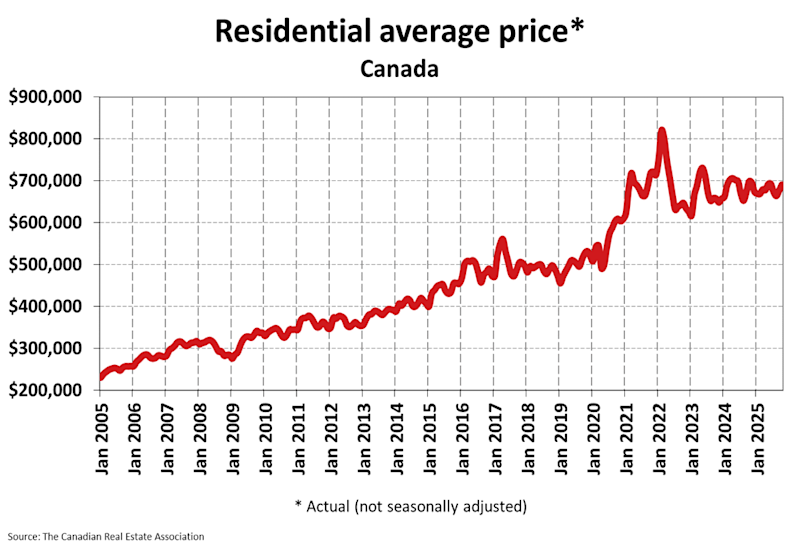

The MLS Home Price Index (HPI) moved up 0.2% month-over-month in October 2025. The actual (not seasonally adjusted) national average sale price was down 1.1% year-over-year.

Housing Sales were up 0.9% month-over-month in October 2025. Actual (not seasonally adjusted) sales were down 4.3% versus the prior year, October 2024.

Housing Market Headlines

- New listing activity was down in October by 1.4% month-over-month - CREA

- Nationally, there were 4.4 months of housing inventory for sale at the end of October 2025, below the long-term average of 5 months - CREA

- After a brief pause in September, home sales across Canada picked up again in October, rejoining the trend in place since April - CREA

- With interest rates now almost in stimulative territory, housing markets are expected to continue to become more active heading into 2026 - CREA

- The Federal Government tabled their 2025 budget. It contained several housing initiatives, including:

GST exemption for first-time buyers of new homes valued up to $1 million and partial rebate of GST for homes between $1 million and $1.5 million (previously announced in May 2025) - Formal launch of Build Canada Homes. This is considered their flagship initiative to coordinate building affordable and non-market housing at scale

- Canada Mortgage Bonds annual limit increased to $80 billion

- More money for the Affordable Housing Fund

- Expansion of indigenous housing commitments

- They also announced the cancellation of the Secondary Suite Loan Program, the Underused Housing Tax and the Canada Greener Homes Grant

- Budget 2025 doubles down on housing investment, but adds few new measures - Canadian Mortgage Trends

- Would-be home sellers are stuck on the sidelines waiting for a market rebound. It could be a long wait - The Globe & Mail

- Vancouver condo market could struggle for the next two years - Times Colonist

- Vancouver home sales down 14% in October from last year - BNN Bloomberg

- Fraser Valley home sales edge up in October, but market remains slow - FVREB

- Richmond land owners face uncertainty after landmark Cowichan court ruling - CMP

- Real estate is expected to be in transition next year as companies look to find new sources of growth, with Calgary's market emerging as a particular bright spot, according to PwC - Financial Post

- 71% of Calgarians say home ownership is out of reach - City News

- Regina ranks among top three Canadian cities for home price growth - Sask Today

- 'Red hot' housing market in October benefited Moose Jaw - Sask Today

- Winnipeg real estate market continues to break records - CTV News

- GTA home sales down 9.5% in October versus last year - TRREB

- GTA housing market shifts toward buyers as prices and mortgage rates fall - Wealth Professional

- Mississauga home prices slip 0.2% in October - Mississauga.com

- Hamilton housing market sees weakest October in more than a decade - The Hamilton Spectator

- Ottawa home prices increase in October - CTV News

- Ontario home sellers face buyers willing to wait for a better deal - The Globe & Mail

- Maritimes housing market still appreciating - CTV News

- Tremendous opportunities for first-time buyers in current market - RE/MAX

- Canada's immigration overhaul to cool housing demand - RBC

- Housing starts were up 1% in October - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.