Monthly Market Update - April 15, 2025

Seldom do we witness such extreme volatility in political and economic headline risk. The ongoing shifts in U.S. tariff policy are creating a chilling effect on Canadian businesses and consumers alike. This heightened uncertainty is proving difficult to navigate, dampening confidence and stalling housing and mortgage market activity

In the face of this uncertainty, the Bank of Canada will be making another rate decision tomorrow. The market is fairly split on expectations for a rate cut. Today the market is pricing the odds of a rate cut at just over 40%. If there is no cut tomorrow, more cuts are still expected and could happen in June or July.

Predicting where rates may go next is always difficult, but today, nearly impossible. Given the risks, it is wise for prospective mortgage borrowers to lock-in rates with a rate hold or mortgage pre-approval. This won't commit you to the held rate but it will provide a cap on rates for you and protect you from the risk that rates may suddenly increase. This is a good risk management tool for new borrowers.

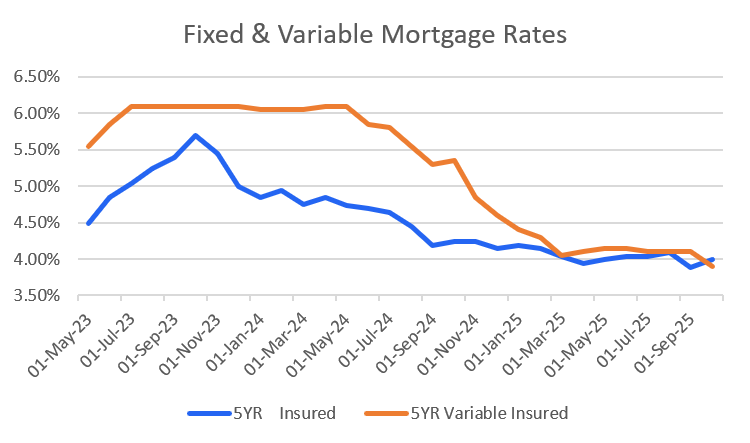

Our best national insured, five-year fixed mortgage rate is now 3.94% and best insured, three-year fixed mortgage rate is 4.04%. In some Provinces, better rates can be found so reach out to us to find out where the best deals are available.

Variable rates are only slightly higher than fixed rates. One more rate cut and they will finally fall below fixed rates once again. Our best national insured, five-year, variable mortgage rate is 4.10%.

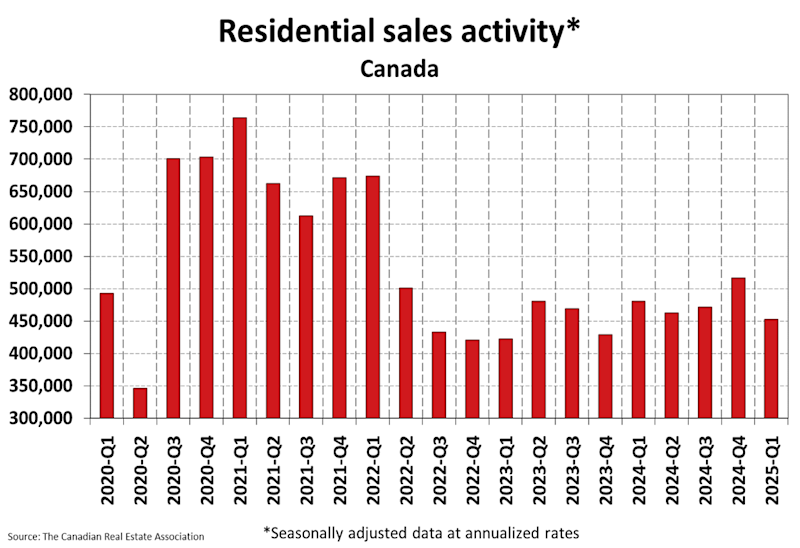

Housing sales were down again in March. Tariff noise, election news and the resulting economic uncertainty provides many market participants good reason to pause activity. Those that are able to stomach the uncertainty can take advantage of the quiet market if they are prepared. Otherwise, once the clouds of uncertainty clear we should see healthy market activity once again.

Mortgage Market

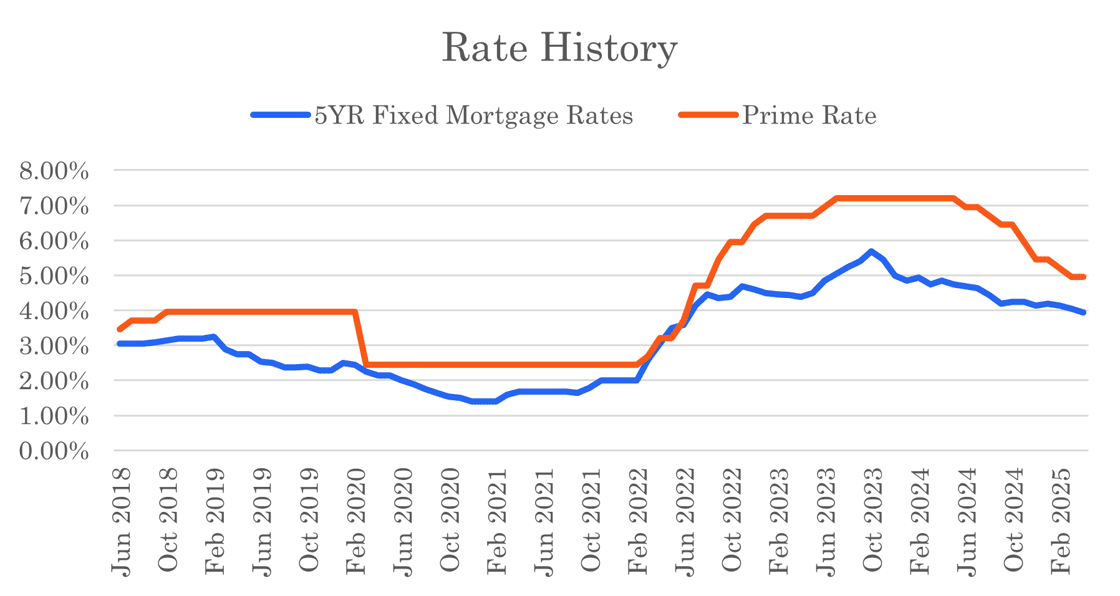

- The prime rate is 4.95%

- Bond yields have varied over the past month but the five-year yield is only 0.08% higher than this time last month.

- The best nationally advertised mortgage rates are in the table below:

- The five year government bond yield is 2.70% today. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates are up slightly as lenders adjust their margins

- Fixed mortgage rates are down as some lenders are being aggressive on pricing

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. The yield curve is flattening, however, and now 3-year mortgage rates are comparable to 5-year rates.

- Poor employment numbers and slumping stock markets keep prospects of an April rate cut alive - BMO

- Bank of Canada is more likely to halt interest rate cuts after tariff pause - Reuters

- Odds of a Bank of Canada rate cut jump as inflation sees surprise drop - CMP

- The big banks are divided on how much the Bank of Canada will cut this year and next - Canadian Mortgage Trend

- Awaiting further rate cuts before refinancing your mortgage? Better to act now - Financial Post

- Trade tensions weigh on Canadian confidence - Bank of Canada

- 64% of variable-rate mortgage holders remain unaffected by higher borrowing costs - CIBC

- 42% of mortgage holders are shopping for better rates - CIBC

- Fixed mortgage rates keep falling, but variable-rate pricing is on the rise - Canadian Mortgage Trends

- Falling rates spell trouble for anyone needing to break their mortgage contract at a bank - Financial Post

- Banks more likely to deny mortgage for workers threatened by Trump tariffs - Toronto Star

- 40.4% of Canadians say they will not fully pay off their mortgages until they are in their 60's - REMIC

- Inflation in Canada slowed to 2.3% in March.

Housing Market

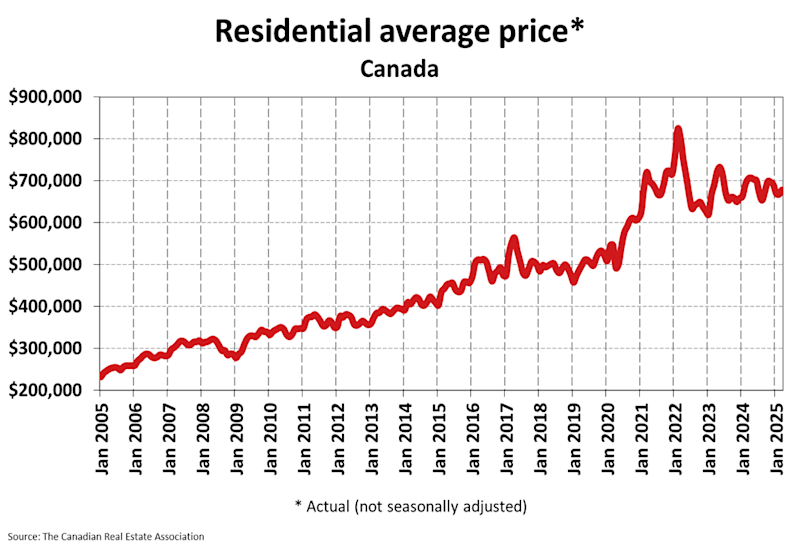

The MLS Home Price Index (HPI) declined 1% month-over-month in March 2025. The actual (not seasonally adjusted) national average sale price fell 3.7% year-over-year. The actual national average home price was $678,331 at the end of March 2025.

Housing Sales fell by 4.8% month-over-month in March 2025. Actual (not seasonally adjusted) sales were down 9.3% versus the prior year, March 2024.

Housing Market Headlines

- New listing activity in March increased 3% month-over-month - CREA

- Nationally, there were 5.1 months of housing inventory for sale at the end of March 2025, inline with the long-term average of 5 months - CREA

- While the trend of falling monthly sales has been observed across Canada over the last few months, there are still many regions where sales are high, inventory is near record lows, and prices are rising - CREA

- Up until this point, declining home sales have mostly been about tariff uncertainty. Going forward, the Canadian housing space will also have to contend with the actual economic fallout - CREA

- Almost half (47%) of prospective homebuyers in Canada have postponed their purchase plans due to concerns about the U.S. trade dispute - Royal LePage & Leger

- A tale of two markets: Real estate activity trending up in Canada's more affordable regions, treading water in the most expensive - Royal LePage

- Vancouver's housing sales lowest for month of March since 2019 - REBGV

- Calgary home sales slide 19% as economic uncertainty grows, prices hold steady - CREB

- Edmonton is Canada's hottest market right now - Real Estate Magazine

- Toronto home sales at a 27 year low - TRREB

- Home sales in Ottawa down yoy in March but prices up slightly - CTV News

- The renewed softening in prices was most notable in British Columbia and Ontario’s Greater Golden Horseshoe. Across much of the Prairies, Quebec, and the East Coast, prices have continued to push higher - CREA

- As sale prices dive, inventory of unsold newly-built Toronto-area condos grows - Globe & Mail

- The outlook for recreational housing remains positive even as economic uncertainty grows - Royal LePage

- Home prices in Canada expected to dip in 2025 - Urbanized

- Canada's homebuyers wait out trade war fallout - RBC

- Amid economic uncertainty majority of Canadian homeowners express confidence in managing mortgage payments and budgets - CIBC

- 54% of Canadians plan to buy a home within the next five years - NerdWallet

- Both Conservatives and Liberals have pledged to cut the GST on new-build homes for some first-time homebuyers - MPC

- Housing starts unchanged since 1970s, while Canadian population growth has more than tripled - Fraser Institute

- Housing starts declined 0.7% in March - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts