Mortgage Rate Forecast For 2026

What are Canadian mortgage rates going to do in 2026? We expect mortgage rates to remain fairly stable through 2026. We think that the Bank of Canada will hold rates steady for much of the year, though some analysts are calling for hikes in the latter half of the year. Bond yields are also expected to remain stable, meaning that fixed mortgage rate should not move much.

Predictions are difficult and the markets are sending mixed signals right now. Read on to find out what this might all mean?

2026 Mortgage Rate Prediction

Mortgage rates should remain within a close range near current rates for most of 2026. Variable mortgage rates will follow the Bank of Canada rates, which are expected to remain flat for the first half of the year. Bond yields could fluctuate with economic news and fixed mortgage rates will follow but are likely to remain within the high-3% to mid-4% range, absent any significant economic surprises.

Variable Mortgage Rates in 2026

We expect variable mortgage rates to remain mostly unchanged in 2026, potentially increasing by 0.25% to 0.50% if the Bank of Canada hikes toward year-end. The one huge caveat to this is that if the ongoing trade discussions with the US go poorly, weakening Canada’s economy, there may be an incentive for the Bank of Canada to make some cuts, as long as inflation remains under control. We do not hope for this poor economic news so prefer to not predict it to be likely.

Variable mortgage rates are now below fixed mortgage rates and should remain there for the time being. We anticipate five-year variable mortgage rates for the best borrowers to range from 3.4% to 4% throughout the year, depending on any policy shifts.

Fixed Mortgage Rates in 2026

We do not expect much change in fixed mortgage rates in 2026, but there is a risk that fixed rates could increase. Bond yields have already priced in limited Bank of Canada cuts and have been stable lately. The recent stability in the US 10-year Treasury yield around 4.2% suggests the bond market is cautious about further cuts. In Canada, bond yields are exactly where they were one year ago, with the five-year Canada bond at 2.88% in late January 2026. We must pay heed to those signals since fixed mortgage rates depend on the bond market. We anticipate five-year fixed mortgage rates to range between 3.7% and 4.3% for most of the year.

We rely on market inputs to generate our own expectations for mortgage rates in 2026. Those key inputs include:

- The Bank of Canada has indicated the current overnight rate of 2.25% is "about right" to keep inflation near 2%, but stands ready to respond if needed;

- Economists are forecasting moderate Canadian economic growth, which may not require further stimulus;

- The US Federal Reserve is expected to cut rates gradually in 2026, potentially two to three times, but with uncertainty from trade policies;

- The US 10-year Treasury yield has hovered around 4.2% in early January 2026;

- Canadian 5-year bond yields are around 2.88% in late January 2026, flat to a year ago and showing no signs of a downward trend; and

- Excessive government borrowing puts pressure on bond yields to rise to entice investors to buy the large volume of government debt

There are many risks that are not priced in yet that could materialize. Economic weakness or tariff impacts could prompt more rate cuts and lower bond yields. The trade agreement between Canada, Mexico and the US expires this year and needs to be renegotiated. Economic strength or resurgent inflation could lead to hikes and higher rates. There are also political and geopolitical risks that are making headlines that are not in our area of expertise. They are difficult to predict but could significantly impact our interest rate markets in 2026, a year currently marked by uncertainty.

What Happened to Mortgage Rates in 2025?

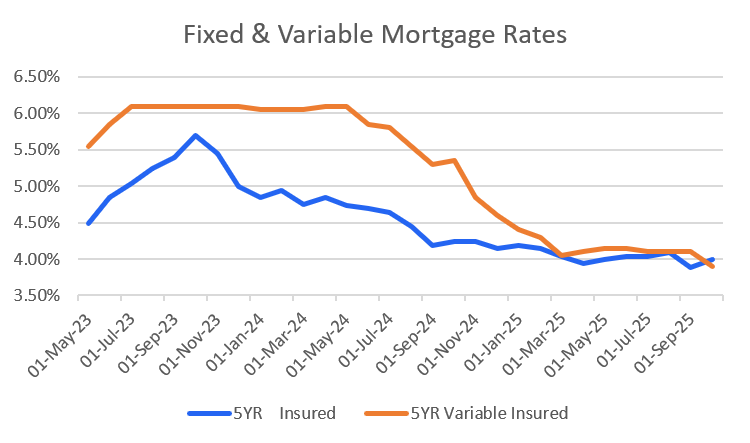

In 2025, Canadian fixed mortgage rates remained relatively stable, declining by a modest 0.20% through the year. Canadian variable-mortgage rates declined by 1.0%, in lockstep with the Bank of Canada reducing their target rate by the same amount in 2025.

The Canadian market entered 2025 with expectations for gradual Bank of Canada cuts, which materialized with reductions totaling 1.00% from January through October. The first cuts came in January and March (0.25% each), followed by holds through summer, then additional 0.25% cuts in September and October. The end result was a reduction in the overnight rate to 2.25% where it remains as we embark on a new year in 2026.

The Bank of Canada rate cuts in 2025 had the expected direct impact on variable mortgage rates, which dropped by the same amount. Fixed rates are ‘forward-looking’, so they moved in anticipation but stabilized as cuts slowed. As the chart shows, fixed mortgage rates have levelled off over the past year.

The bond market is forward looking and this graph depicts that. Fixed mortgage rates began declining far before the Bank of Canada began making cuts, eventually reducing variable mortgage rates.

Fixed mortgage rates (for insured mortgages) started 2025 at 4.19% and declined to around 3.99% by year-end.

Variable mortgage rates (for insured mortgages) started 2025 at 4.60% and declined to 3.60% by year-end, a decline of 1.0%.

Historically, variable mortgage rates tend to be lower than fixed mortgage rates. After three years where that was not the case, this relationship between variable mortgage rates and fixed mortgage rates has returned, where variable mortgage rates are lower.

What Interest Rates Affect Mortgage Rates?

There are two key underlying market rates that mortgage borrowers should be aware of - the Prime Rate (influenced by Bank of Canada rates) and five-year government bond yields.

The Prime Rate

The prime rate is defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by several factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight target rate set by the Bank of Canada. The prime rate is currently 4.45%, as of Jan 26, 2026.

The Five-Year Government of Canada Bond Yield

There are a variety of Canada government bonds that trade daily in the bond market. They have terms to maturity ranging from overnight to 30-year bonds. The five-year Canada bond is a benchmark pricing bond for mortgages. This is because mortgage funding vehicles like mortgage-backed securities are priced off this bond.

The bond market sets the price of the bonds, and the bonds are forward looking. This means their current price is somewhat based on bond investor expectations for the future economic prospects of the country that issued the bonds. Factors like economic growth, employment and inflation influence the price of the bonds. The five-year government of Canada bond yield is currently 2.88% (as of Jan 26, 2026), only about 0.15% above where it was at this time in late Jan 2025.

Recent Canadian Interest Rate History

Rates have been lower than historical averages since the economy exited from the 2008-2009 financial crisis. There have been some ups and downs, but central banks held rates low for an unusually long time from 2010 to 2022. Not only had rates been trending lower but the reduction of rates in response to the Covid lockdowns was unprecedented.

Unfortunately, an extended period of low rates combined with massive government stimulus in response to Covid lockdowns fueled a period of inflation. Central banks failed to anticipate inflation and were forced to rapidly increase rates in 2022 once it took hold. The Bank of Canada raised their target interest rate by 4.0% in 2022, the largest ever one-year increase. They raised it another 0.75% in 2023.

Being a predictor of the future, the bond market responded to inflation as well and bond yields rose in 2022 and 2023. This pushed fixed mortgage rates higher.

The Bank of Canada made their first cut in four years on June 5, 2024. Eight more cuts, totaling 2.75% have been made since then by the Bank of Canada. Bond yields declined in 2024 and have levelled off. The five-year Canada bond yield has held below 3% for most of the past year.

What Have Mortgage Rates Done Recently?

Fixed mortgage rates declined modestly in 2025 but have flattened out in recent months. The best five-year fixed, insured mortgage rates are now 3.89%.

Variable mortgage rates declined by 1.00% in 2025 due to the rate cuts by the Bank of Canada. The best five-year variable, insured mortgage rates are now 3.60%. Variable rates will only change materially in response to Bank of Canada rate adjustments. Sometimes there are small adjustments as lenders adjust their margin requirements.

Will Mortgage Rates Decline in Canada in 2026?

We do not anticipate any material decline in mortgage rates in 2026. We expect fixed mortgage rates to move around within a range. They may move up or down slightly but are likely to remain in the high-3% to mid-4% range in 2026. We expect variable mortgage rates to remain steady for most of the year. There are some analysts predicting that the Bank of Canada could hike rates in late 2026, causing variable mortgage rates to also increase, but this cannot be predicted with any certainty. There are many pundits and bank analysts that are paid to make predictions. It is a difficult game, and they are wrong more often than they are right.

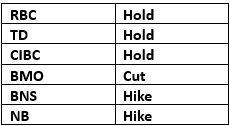

As we begin 2026 the banks are mixed on their predictions on the Bank of Canada’s next move. Most think any such move would only come in the latter half of 2026, with the bank of Canada leaving rates unchanged for the first half of the year. Here is what each of them says the next move from the Bank of Canada will be:

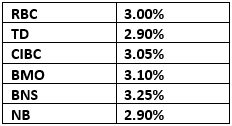

The banks are also predicting stable or slightly higher bond yields in 2026. There are no predictions from them for any significant changes in bond yields and none of them predict bond yields will decline. Here are the big six bank’s year-end 2026 predictions for the government of Canada five-year bond yield (current yield is 2.88%):

If this majority view of relatively stable yields is accurate then borrowers can expect stable mortgage rates in 2026 but with potential for modest increases by year-end.

A return to the abnormally low rates we experienced in recent years is not likely. Absent any sudden economic shock, bond yields will tend to range between 2% and 4% over time. The five-year Canada bond yield today (January 26, 2026) is 2.88%. We are currently in a relatively normal interest rate environment.

Could Mortgage Rates Increase in Canada in 2026?

Yes, it may be possible that mortgage rates increase slightly toward the end of the year. If the bank analysts’ views on interest rates are accurate then a significant increase in mortgage rates is unlikely, although some minor movement up and down is possible with fixed mortgage rates. The main risks to these forecasts are i) the possibility that inflation picks up due to tariffs or other factors, ii) economic strength in early 2026 could push up bond yields and prompt central bank hikes, or iii) trade negotiations go poorly, reducing economic output and confidence.

How Can You Stay Informed About Interest Rates?

The Bank of Canada interest rate announcements are news to keep an eye on. They make these announcements on preset dates. The schedule for 2026 is:

If you would like to keep track of the five-year government of Canada bond you can track it for free on the internet. There are many websites that let you do this, and an online search will help you find one. Here is a link to one such site -

https://www.marketwatch.com/investing/5yr canada bond

For current mortgage rates you can go to

frankmortgage.comto see our mortgage rates that are updated daily.

You can also sign up for our monthly mortgage market update email. It provides a summary of monthly activity in the mortgage and housing markets, including an update on interest rates.

Mortgage Rate Advice for 2026

Mortgage borrowers today are facing a stable environment compared to the past couple years. This is good news. A stable rate environment is a sign the market is settling and perhaps a return to normal is around the corner.

Mortgage rates are down from the highs. With steady rates and housing prices down in several markets, housing affordability has improved. We talk to many customers that are stressed about their mortgage renewal or are bogged down in the math. Things are not as complicated as they seem, especially if you acknowledge how much things have improved since 2023.

Rates may hold or rise slightly in 2026 and waiting for further rate declines can lead to frustration. Find out what you can afford at current rates and act on it. If rates were to ease a bit in 2026, you will likely benefit by the time you actually close a new mortgage.

Variable-rate mortgages are not for everyone. As many have painfully learned over the past few years they come with risk. The risk of higher rates over the next few years exists, so only consider variable rates if you can afford to bear that risk or need the flexibility to break the mortgage in the future (prepayment penalties are lower for variable-rate mortgages).

Fixed rates are settling into a range. Yes, they may decline but that is only likely in response to economic weakness. We have to be careful what we wish for. The past year has seen many borrowers go for shorter terms but as we are now at the end of the rate cutting cycle it might be time to consider taking the longest term you can afford.

We are optimistic for a more active housing market in 2026, but challenges persist. Urban condominium markets may continue to struggle. Detached housing looks to be in better health. Supply has increased in many markets and homebuyers that have their mortgage financing figured out stand to benefit.

We expect most customers to continue to favor fixed rates due to an aversion to interest rate risk and the predictability of fixed payments. Finding a fixed mortgage rate you can afford and then putting it away for five years so you don't have to worry about rates is a good choice.

We also caution all customers to take interest rate predictions with a grain of salt. The bank analysts that make market predictions like those noted above were correct about some cuts in 2025 but got it wrong in 2024, 2023 and 2022. What are the odds they get it right this year? Do your own research and seek out opposing views to get the whole picture to inform your own opinions and decisions.

We are here to help you navigate the mortgage market and find your best mortgages. Please click below to find our best rates.

If you would like a free consultation with a mortgage expert please click here:

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.