Monthly Market Update - December 15, 2025

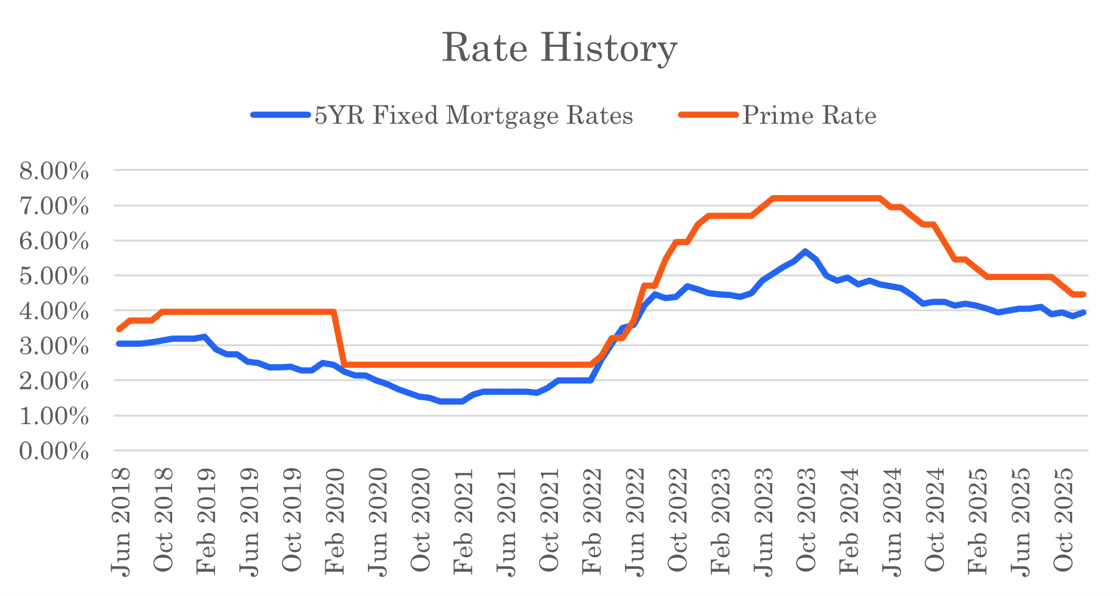

The mortgage market appears to be entering a period of relative rate stability. After the Bank of Canada held their benchmark rate at 2.25% on Dec 10, market expectations are for no further rate cuts into the first half of 2026. Bond yields have moved up slightly, but the 5 year Canada bond yield remains below 3%, allowing for 5-year fixed mortgage rates near 4% for the best borrowers.

Bank of Canada rates are now 1.0% lower than they were at the end of 2024. Fixed mortgage rates are only lower by about 0.20% versus a year ago. Homebuyers should run the numbers with today's rates to check their affordability. With rates now lower and house prices also down in several markets, affordability has improved year-over-year. Buying power for homebuyers has increased materially - by over 20% in just the past two years. Not only can today's low rates benefit homebuyers but there can also be savings for existing borrowers looking to refinance out of a high rate mortgage.

Since we expect rates to stabilize near current levels for the near term, the mortgage conversation will shift to more typical topics like affordability, product features, and borrower needs. Keen rate observers may not find much interesting in the rate discussion for awhile, but there may still be some variations as bond yields tend to fluctuate and some lenders might offer some rate specials from time-to-time. However, those waiting for rates to materially drop further may be disappointed.

The best way to know which lenders have good offers and when they are being offered is to work with an experienced mortgage broker. Check with Frank Mortgage to find out where the best rates can be found to maximize your mortgage outcome. To check on your affordability today, have us run the numbers for you for free.

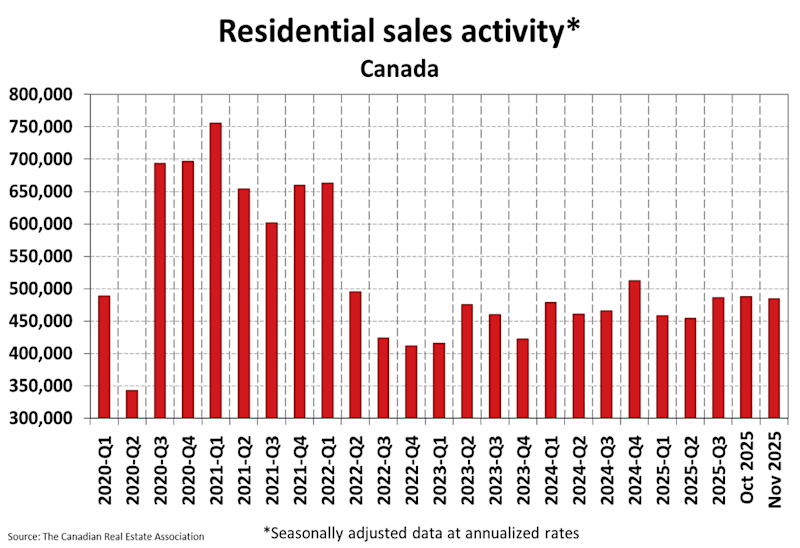

In the housing market, sales were down in November on a national level month-over-month. As we head into the holiday season we anticipate a quiet market but sentiment is positive for a pick-up in activity in the new year.

Mortgage Market

- The prime rate is 4.45%

- The best nationally advertised mortgage rates are in the table below. There are often regional rates that are better, so check with your mortgage broker.

- The five year government bond yield is 2.91% today, 0.16% higher than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates held steady through the last month and will remain unchanged going forward if the Bank of Canada holds rates steady.

- Fixed mortgage rates increased at some lenders in the last week

- The Bank of Canada held the benchmark rate at 2.25%, the bottom of the bank's neutral range - Canadian Mortgage Professional

- In the current situation, the Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment - The Bank of Canada

- Going forward we see the Bank of Canada holding steady through at least the first half of the year - National Bank

- We think the Bank is done with rate cuts, and that the next change of interest rates is more likely to be a hike - RBC

- We shifted our call to no rate changes for all of 2026 - BMO

- A surge in mergers is reshaping the mortgage industry - Canadian Mortgage Trends

- Nearly half (46%) of homebuyers said mortgage terms were the most confusing part of closing, and 37% reported moderate to significant financial stress due to unclear or unexpected costs - Ownwell survey

- About 1.15 million mortgage will renew in 2026, with a further 940,000 scheduled for 2027 - CMHC

- Canadian mortgage delinquency rate falls for first time in three years - CMHC

- Reverse mortgage volume growth is off the charts - MortgageLogic.news

- Mortgage interest costs dip as two-thirds of the decline in household property income payments of 0.6% came from lower mortgage interest - Stats Canada

- Mortgage payments for typical home now exceeds 50% of after-tax family income in every Ontario urban centre; 110% in Toronto - Fraser Institute

- Inflation in Canada remained unchanged at 2.2% in November

Housing Market

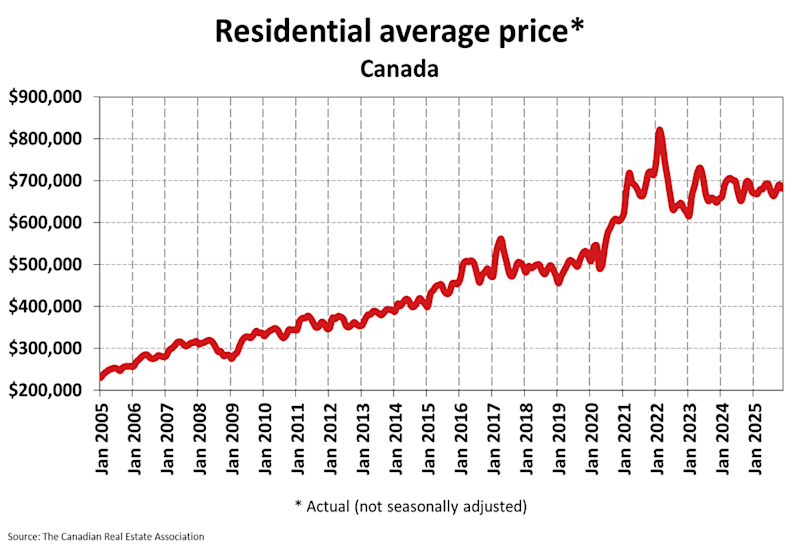

The MLS Home Price Index (HPI) dropped 0.4% month-over-month in November 2025. The actual (not seasonally adjusted) national average sale price was down 2% year-over-year.

Housing Sales declined 0.6% month-over-month in November 2025. Actual (not seasonally adjusted) sales were down 10.7% versus the prior year, November 2024.

Housing Market Headlines

- New listing activity was down in November by 1.6% month-over-month - CREA

- Nationally, there were 4.4 months of housing inventory for sale at the end of November 2025, below the long-term average of 5 months - CREA

- At this point it's looking like the mid-year rally in housing demand has veered into more of a holding pattern heading into 2026, coupled with what looks like some price concessions in November in order to get deals done before the end of the year - CREA

- The Bank of Canada's clear signal that rates are now about as good as they're likely to get is the green light many fixed-rate borrowers have no doubt been waiting for, so we remain of the view that activity will continue to pick up next year - CREA

- Motivated buyers signal renewed housing market confidence heading into 2026 - RE/MAX

- Improved affordability expected to draw Canadians back into the market through 2026 - Royal LePage

- Trade uncertainty kept the housing market in a holding pattern - RE/MAX

- A new global study finds Canadians wait longer than most young buyers worldwide to enter the housing market - Canadian Mortgage Trends

- The GVA appears set for its lowest year of home sales in a quarter-century - CBC

- Vancouver home prices expected to fall 3.5% in 2026 - Royal LePage

- Inventory levels are soaring in Calgary, jumping by 28% year-over-year in November - CREB

- Calgary is among a group of cities expected to see up to 2% price growth in 2026 - Royal LePage

- Edmonton remains a seller's market - Zoocasa

- Saskatchewan's low housing inventory continues to challenge the industry - CTV News

- Winnipeg ytd housing sales up 4% - WRREB

- New home sales in the GTA have hit their lowest point in over a decade, marking 13 consecutive months of record-breaking declines - Canadian Mortgage Professional

- Only 54 condos sold in Toronto last month - CTV News

- Continuing economic uncertainty and concern about the labour market are still weighing against the housing outlook in Toronto - TRREB

- The composite benchmark price of a home in Ottawa was up 0.9% from November 2024 - Wowa.ca

- Halifax housing construction up significantly this year, with thousands of units underway - CBC

- Ontario appoints administrator to take control of real estate regulator - The Globe & Mail

- RECO freezes accounts at another real estate brokerage - CityNews

- Nearly half of first-time homebuyers worry about making the wrong decision and place clarity and guidance at the top of their needs when taking their first step into homeownership - Scotiabank Survey

- 62% of potential first-time buyers say the current economic environment is negatively impacting their finances and delaying plans - Scotiabank Survey

- Housing starts were up 1% in October - CMHC

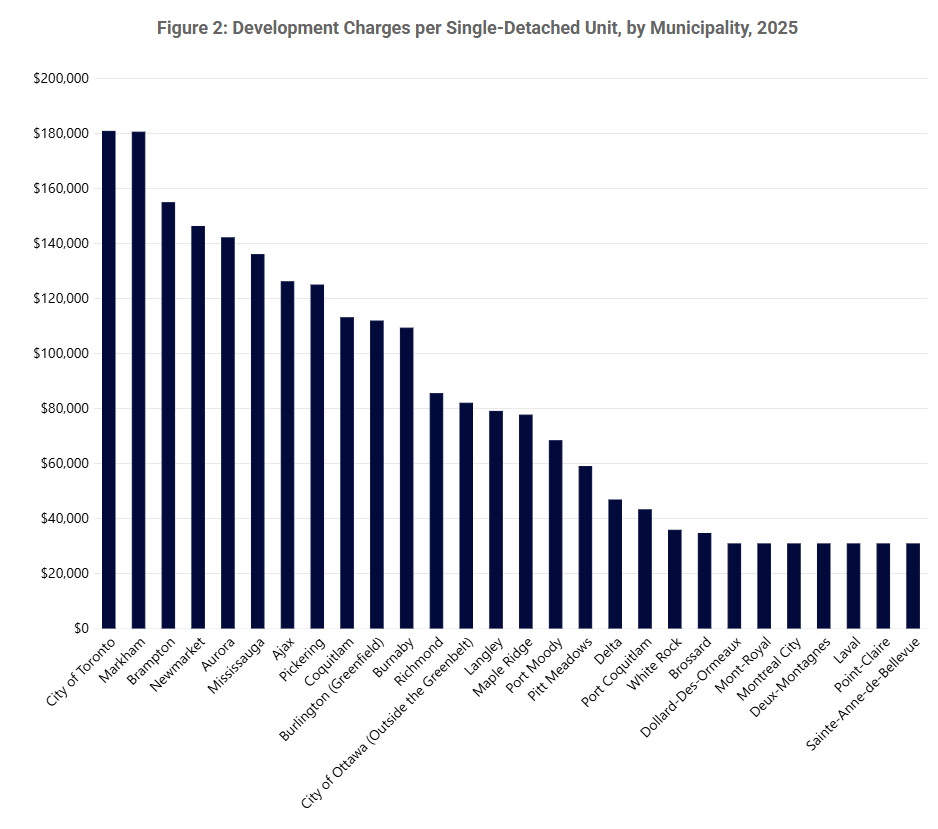

- CMHC compiled development charge data across Canada and warns that soaring development charges are reshaping housing costs. The results show a wide disparity across municipalities (see CMHC chart below):

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts