Monthly Market Update - January 15, 2026

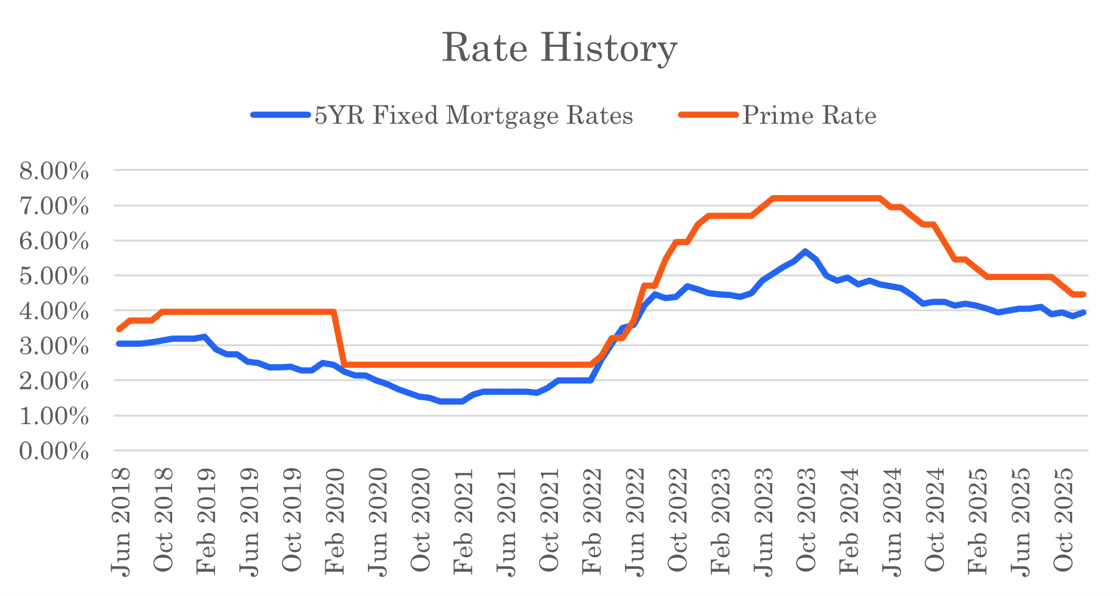

As we begin a new year, the housing and mortgage markets remain challenged by uncertainty and hesitation. Mortgage rates have declined through the year, but appear to be leveling off. The housing market is a mixed story depending on where you are. Weakness in Toronto and Vancouver are offset by relative strength in Edmonton, Winnipeg, Saskatoon, Halifax and elsewhere.

Now that rates have leveled off, hopefully less time is spent speculating about interest rates. Those conversations can be unproductive and lead to distraction. This new found clarity about rates and the improved affordability we see today, should contribute to confidence that can help restore momentum.

The next Bank of Canada announcement is on January 28, but the market does not expect a change in rates. In fact, the market largely expects the Bank to hold rates steady for the next few months. Nevertheless, the good news is that Bank of Canada rates are now 1.0% lower than they were at the end of 2024.

Fixed mortgage rates in the high 3% to mid 4% range. This is a normal and healthy level for rates. We expect fixed mortgage rates to bounce around this range for the time being, but they will be sensitive to economic surprises which may be possible in the coming months.

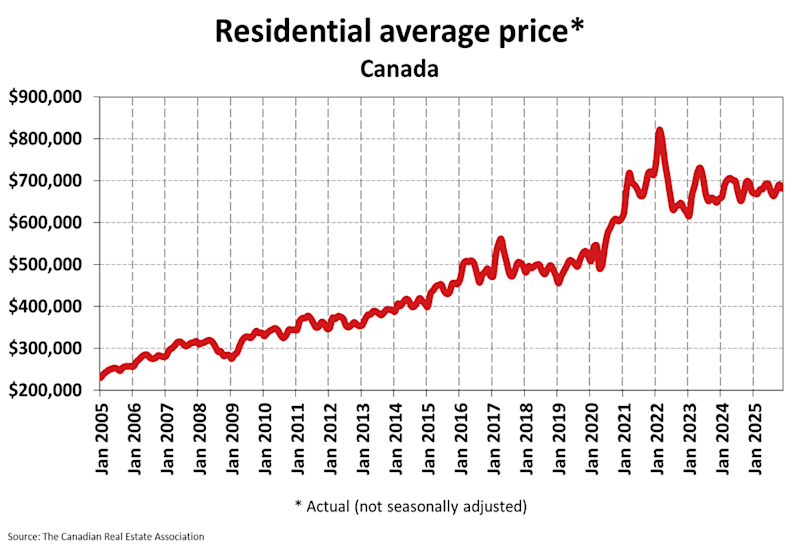

If you are hesitant to step off the sidelines, let us arm you with the information you need to confidently make a decision. The more information you have, the better decision you will make. Homebuyers should run the numbers with their mortgage broker using today's rates to check their affordability. With rates now lower and house prices down in several markets, affordability has improved year-over-year. Buying power for homebuyers has increased materially - by over 20% in just the past two years. Not only can today's low rates benefit homebuyers but there can also be savings for existing borrowers looking to refinance out of a high rate mortgage or consolidate debts.

Those waiting for rates to materially drop further may be disappointed. No more excuses. The mortgage market is now in a readjustment phase as borrowers get used to this level of interest rates and home buyers and sellers try to determine the market price level.

Several mortgage lenders have lowered their rates in the past week. Be sure to work with an experienced broker with access to all the lenders so you can find these deals. Larger mortgage brokers, like Frank Mortgage, often have lender specials that are not advertised. For instance, we currently have five-year, fixed mortgage rates for borrowers with more than 20% down payment as low as 3.90% in some major markets.

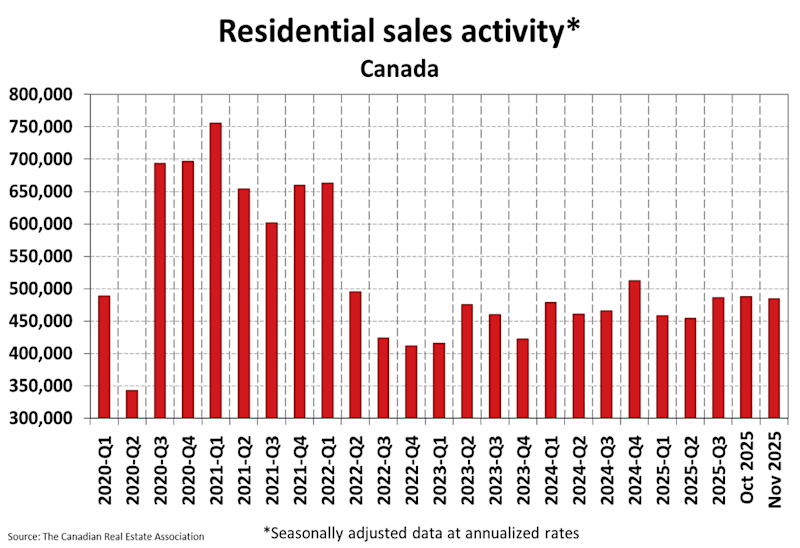

In the housing market, sales were down in December on a national level month-over-month. Inventories remain high. The advantage is to the buyers today

Mortgage Market

- The prime rate is 4.45%

- The best nationally advertised mortgage rates are in the table below. There are often regional rates that are better, so check with your mortgage broker.

- The five year government bond yield is 2.85% today, 0.06% lower than last month. It peaked at 4.42% in October 2023.

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates held steady through the last month but can vary slightly based on lender margin requirements

- Fixed mortgage rates for insured mortgages dropped and for uninsured mortgages increased. We may see these rates bounce around in the near term, depending on lender pricing expectations and competition

- The central bank's benchmark rate at 2.25% is 'at about the right level' to support a period of modest growth while keeping inflation near target - Bank of Canada

- GDP slide hardens case for Bank of Canada to stay on hold - Canadian Mortgage professional

- The recent enthusiasm for variable rate mortgages may wane in 2026, especially if borrowers start anticipating new rate increases - Desjardins

- A surge in mergers is reshaping the mortgage industry - Canadian Mortgage Trends

- In an uncertain world, mortgage rates have remained surprisingly stable - Financial Post

- The average mortgage rate will double for those who bought in 2021 on a five-year term .... increasing payments by about 26% - Vancouver Sun

- Close to half of homebuyers use a mortgage broker for their financing - Globe & Mail

- Mortgage renewers take note: there's never been a better time to switch lenders - Financial Post

- More than a million Canadian homeowners will need to renew their mortgages in 2026 - Globe & Mail

- There is much speculation in the market that OSFI is considering moving away from the mortgage stress test in favour of a loan-to-income test. We expect an update from OSFI on Jan 29.

- Inflation in Canada remained unchanged at 2.2% in November. Data for December will announced on Jan 19.

Housing Market

The MLS Home Price Index (HPI) dropped 0.3% month-over-month in December 2025. The actual (not seasonally adjusted) national average sale price was only down 0.1% year-over-year.

Housing Sales declined 2.7% month-over-month in December 2025. Actual (not seasonally adjusted) sales were down 4.5% versus the prior year, December 2024.

Housing Market Headlines

- New listing activity was down 2% in December month-over-month, marking the fourth straight drop - CREA

- Nationally, there were 4.5 months of housing inventory for sale at the end of December 2025, below the long-term average of 5 months - CREA

- There doesn’t appear to have been much rhyme or reason to the month - over-month decline in home sales in December, which was simply the result of coincident but seemingly unrelated slowdowns in Vancouver, Calgary, Edmonton, and Montreal - CREA

- We continue to expect sales to move higher again as we get closer to the spring, rejoining the upward trend that was observed throughout the spring, summer, and early fall of last year. - CREA

- Economists expect a gradual housing recovery in 2026 as lower interest rates support demand - Canadian Mortgage Trends

- Motivated buyers signal renewed housing market confidence heading into 2026 - RE/MAX

- Solid market fundamentals, including lower interest rates, increased supply, and reduced competition, have created a more favorable environment for consumers - Royal LePage

- Canadian homebuyers are playing a waiting game in a showdown with sellers, whose ranks have swelled in the past couple of years in parts of the country - RBC

- With the central bank signaling it's done this cycle, it could be the hint some buyers were waiting for to make a move - RBC

- Lower immigration will be a bit of a dampener on consumer spending and, of course, the housing markets and rental markets for a little while - BMO

- Vancouver area saw least home sales in more than two decades in 2025 - GVR

- 2025 Fraser Valley real estate market slowest in over 2 decades - FVREB

- BC home sales and prices both down about 6% last month, amid lower mainland slump - BCREA

- Calgary housing market closed out 2025 with 14% fewer home sales in December - CREB

- Edmonton's housing affordability edge could slip in 2026 - Conference Board of Canada

- Winnipeg real estate sales 'soldiered on', armed with affordability - WRREB

- Toronto housing market ended year with declines in prices and deals in Dec - TRREB

- New listings in the GTA jumped 5.5% in December from the previous month - TRREB

- Ottawa sees increase in housing sales in 2025 - CTV News

- While homes sales have been on the wane in Nova Scotia in recent months, prices are proving resilient - Mpamag.com

- Sales in Canadian housing market, including the GTA, saw drop not seen in decades - Toronto Sun

- Average asking rents across Canada declined in Dec for the fifteenth consecutive month - Rentals.ca and Urbanation

- Housing starts up 5.6% in 2025, versus 2024 - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts