Monthly Market Update - July 15, 2025

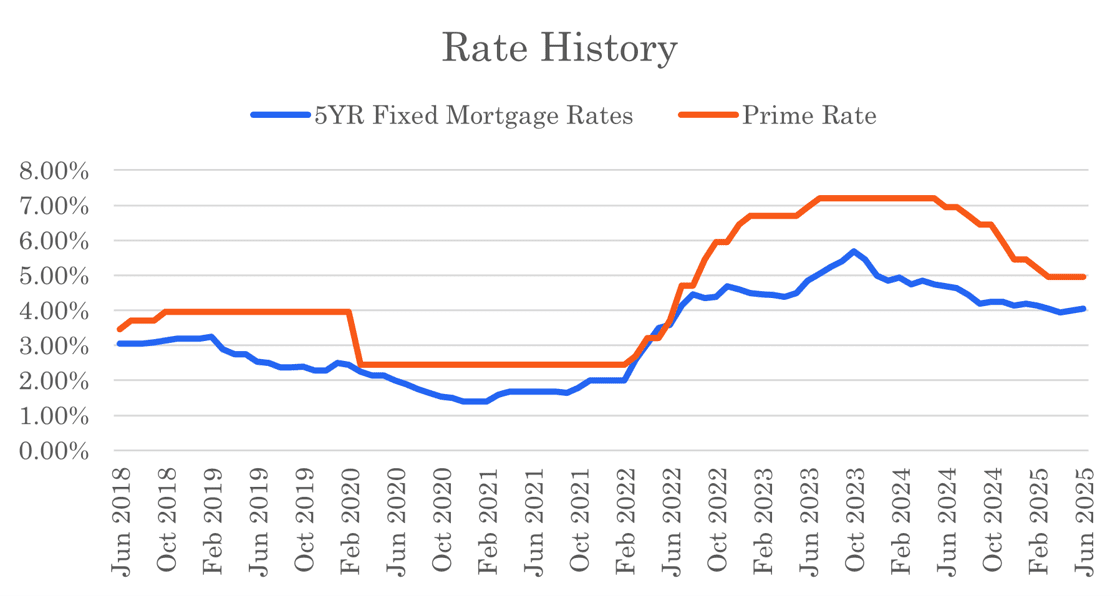

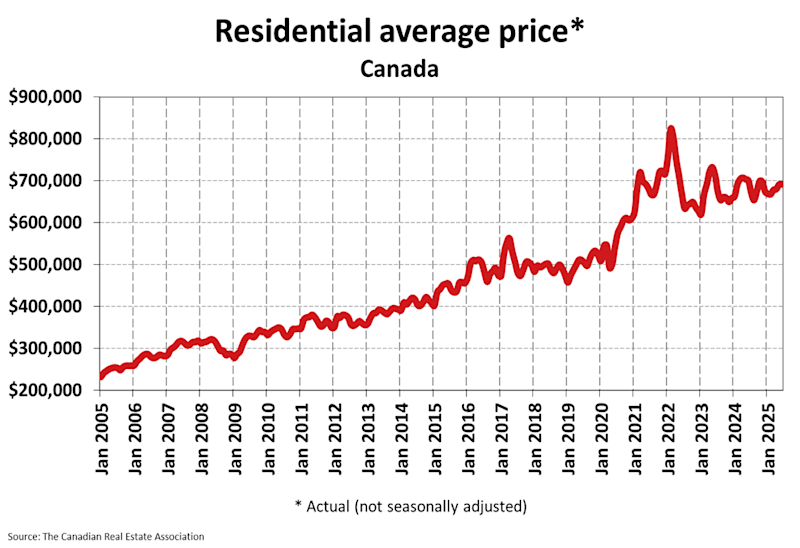

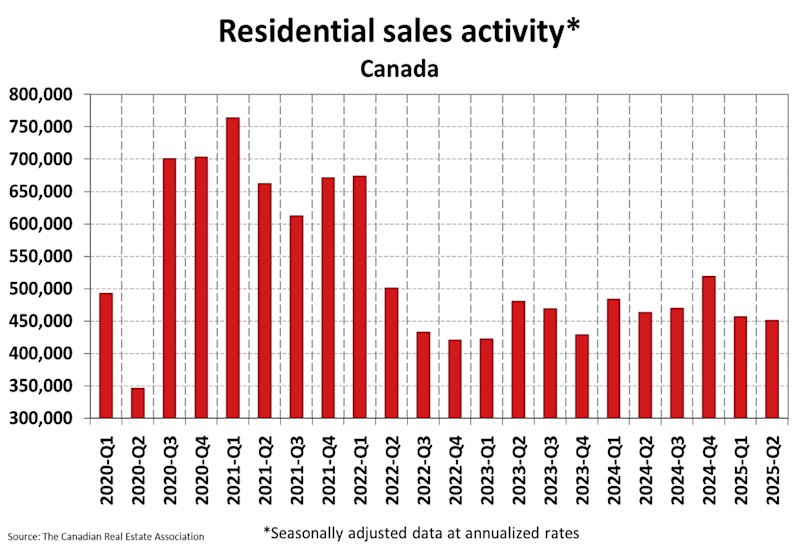

The market remains quiet and interest rates look likely to remain near current levels in the near term. While this may not sound positive at first, the overall picture is actually encouraging for many prospective homebuyers. Home prices are down in some markets. Inventory levels are higher across much of the country, creating a buyer's market. On top of that, mortgage rates are about 2% lower than they were just two years ago, leading to a meaningful improvement in affordability.

Higher priced markets like Toronto and Vancouver still pose affordability challenges, but conditions have eased somewhat. While there’s little indication that interest rates will fall further, today’s rates are very compelling given that they are in line with historical averages. All things considered, this is an excellent moment to re-evaluate your options and take a fresh look at the opportunities in today's market.

The Bank of Canada did not make a rate announcement in the last 30 days but in a recent speech, Tiff Macklem, the Governor of the Bank of Canada, indicated that he is in no rush to cut rates further. As expected, variable mortgage rates have held steady over the past month.

Bond yields increased 0.14% since this time last month and by 0.38% since two months prior. There is upward pressure on fixed mortgage rates and in the last day, two of our A-lenders have increased their rates. There is a chance that all A-lenders increase their mortgage rates in the coming days.

This rate volatility highlights the benefit of a pre-approval. Those of you with pre-approvals at lower rates are ahead of the game now and better prepared than others. You stand to benefit financially from the free option that a pre-approval provides you.

Our best national insured, five-year fixed mortgage rate is now 4.04% and best insured, three-year fixed mortgage rate is 4.14%.

Variable mortgage rates will drop again upon the next Bank of Canada cut. Any signals of Canadian economic weakness may lead to those cuts coming sooner rather than later. However, the jobs report last week was stronger than expected and the inflation data released today showed that core inflation remains stubbornly elevated.

Variable rates are very close to fixed rates. Our best national insured, five-year, variable mortgage rate is 4.10%.

Housing sales rose again in June on a national level. The market remains sluggish but signs are pointing to recovery and increased activity, perhaps as soon as this fall. With improved affordability and a buyer's market in many housing markets we are cautiously optimistic.

Mortgage Market

- The prime rate is 4.95%

- The best nationally advertised mortgage rates are in the table below:

- The five year government bond yield is 3.13% today, 0.14% higher than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates remain steady

- Fixed mortgage rates holding in despite higher bond yields

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. The yield curve is flattening, however, and now 3-year mortgage rates are comparable to 5-year rates.

- BoC to look for stronger signals before cutting as inflation holds steady - MPA Mag

- The Bank of Canada appears to have reached the end of its cutting cycle, with the policy rate now in the middle of the neutral range - RBC

- Hopes of July BoC rate cut fade after strong jobs data - Canadian Mortgage Professional

- Even if the Bank of Canada cuts further, mortgage borrowers shouldn't expect materially lower fixed rates - National Bank

- Canadians poised to weather mortgage renewal storm - TD

- Inflation in Canada rose to 1.9% in June.

Housing Market

The MLS Home Price Index (HPI) declined slightly by 0.2% month-over-month in June 2025. The actual (not seasonally adjusted) national average sale price fell 1.3% year-over-year. The actual national average home price was $691,643 at the end of June 2025.

Housing Sales increased by 2.8% month-over-month in June 2025. Actual (not seasonally adjusted) sales were up 3.5% versus the prior year, June 2024.

Housing Market Headlines

- New listing activity declined in June by 2.9% month-over-month - CREA

- Nationally, there were 4.7 months of housing inventory for sale at the end of June 2025, inline with the long-term average of 5 months - CREA

- At the national level, June was pretty close to a carbon copy of May, with sales up about 3% on a month-over-month basis and prices once again holding steady - CREA

- If the spring market was mostly held back by economic uncertainty, barring any further big shocks, that delayed activity could very likely surface this summer and into the fall - CREA

- Spring market stumbles to a sluggish start with economic unease a drag on homebuying activity in Q2 - Royal LePage

- Home prices favour buyers in some Canadian markets, sellers in others - RBC

- Homeownership most affordable in 3 years - Royal LePage

- B.C. homes sales up slightly, everywhere except Lower Mainland - City News

- A cool down in Vancouver's condo market is sparking fears that the space could see a similar crisis to Toronto - Globe & Mail

- Inventory spike cools Calgary home prices, especially for condos - Canadian Mortgage Trends

- Saskatoon draws out-of-Province homebuyers as Canadians seek affordable mortgages - Canadian Mortgage Professional

- Winnipeg real estate hits record highs - CTV News

- Ottawa's housing market has busiest June in quite some time - OREB

- GTA sales in June were 2.4% lower than prior June, but 8.1% higher than May, showing signs of recovery - TREBB

- Underbidding on homes hits near-record high in the GTA - Insauga

- Atlantic Canadians hesitant to buy homes despite lower interest rates - City News

- Housing supply constraints are driving price growth, and stable-to-declining mortgage rates are helping sustain demand despite slowing global economic growth - Fitch

- Housing market to pick up starting in late 2025 - TD

- 54% of those currently renting their homes plan to purchase a property in five years or less, with 1/3 saying they plan to do so within the next two years - Royal LePage

- Ontario has the biggest housing supply gap - CTV News

- Canada sees largest monthly decline in residential construction investment since 2021 - Canadian Mortgage Trends

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts