Monthly Market Update - June 15, 2025

Now is a great time to take a fresh look at the opportunities in the market. With more listings available and many homes selling below asking price, buyers have more choice and negotiating power. Mortgage rates, when viewed historically, are within a normal, and relatively low, range. At the same time, rising wages are helping to improve overall affordability.

It’s a smart moment to focus on what you can control. Whether you're thinking about entering the market, renewing, or refinancing, preparing now puts you in a stronger position. Every market slowdown eventually ends, and being ready when it does can make all the difference.

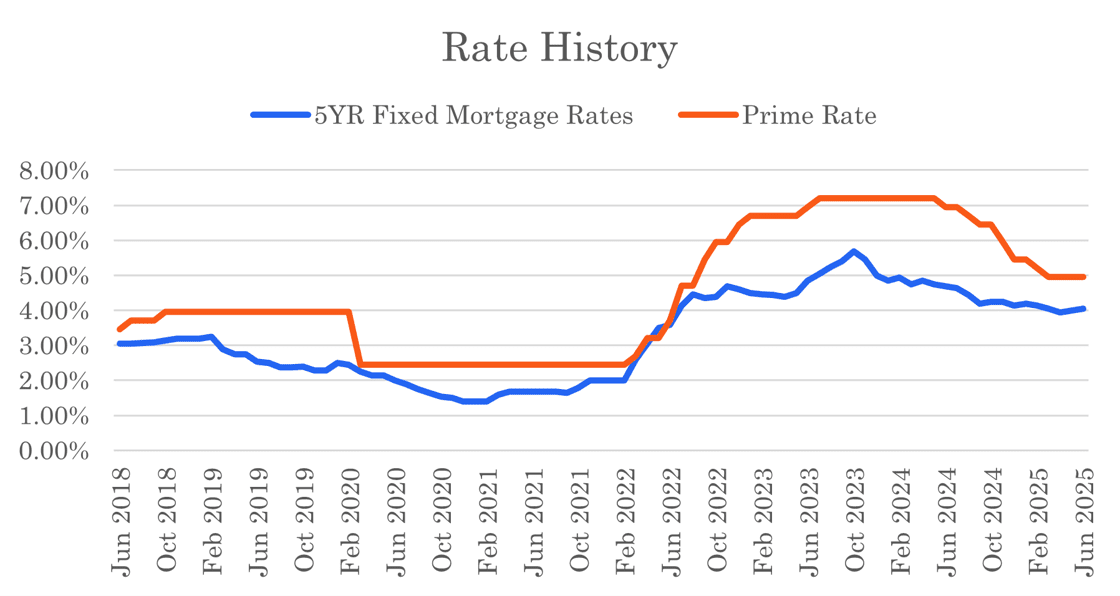

The Bank of Canada held rates steady on June 4. They said that the economy is softer but not sharply weaker and also cited stronger inflation data. Uncertainty with tariffs continued to give them pause as well.

Variable rates at most lenders remain unchanged as a result, but a couple lenders have lowered their margins so better deals are now available. Analysts are split on whether the Bank of Canada will cut rates again in July. Recent strong economic and inflation data means they may not be in a rush to cut.

Bond yields increased more than 0.20% since this time last month. This initially led to all A-lenders increasing their fixed mortgage rates. However, a couple lenders became more aggressive in recent days and lowered uninsured mortgage rates. As a result, fixed mortgage rates today are mixed but comparable to where they were last month.

This rate volatility highlights the benefit of a pre-approval. Those of you with pre-approvals at lower rates are ahead of the game now and better prepared than others. You stand to benefit financially from the free option that a pre-approval provides you.

Our best national insured, five-year fixed mortgage rate is now 4.04% and best insured, three-year fixed mortgage rate is 4.09%.

Variable mortgage rates will drop again upon the next Bank of Canada cut. Any signals of Canadian economic weakness may lead to those cuts coming sooner rather than later.

Variable rates are only slightly higher than fixed rates. One more rate cut and they will finally fall below fixed rates once again. Our best national insured, five-year, variable mortgage rate is 4.30%.

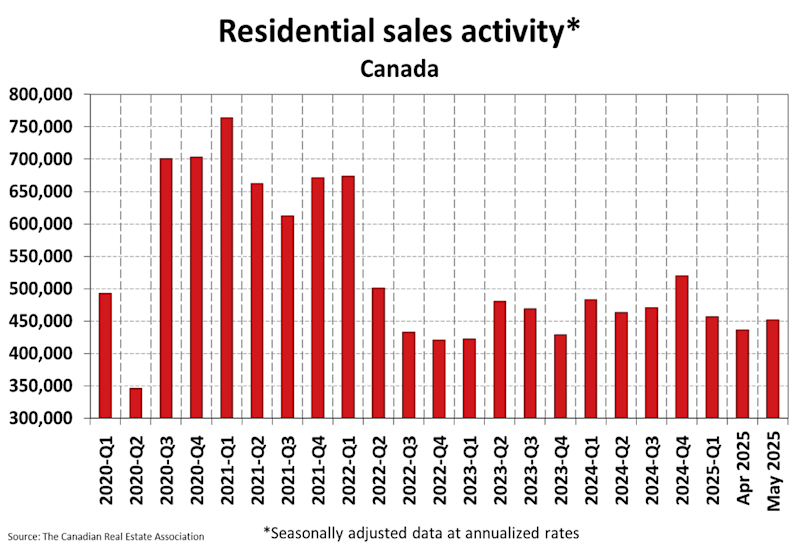

Housing sales rose in May, potentially signaling some life in the market once again. This depends on your location, though. We are now in a buyer's market in many major markets and if you are looking to enter the market, your chances of finding an affordable price are improving.

Mortgage Market

- The prime rate is 4.95%

- The best nationally advertised mortgage rates are in the table below:

- The five year government bond yield is 2.99% today, 0.24% higher than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Some variable mortgage rates are down as lenders adjust their margins

- Fixed mortgage rates holding in despite higher bond yields

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. The yield curve is flattening, however, and now 3-year mortgage rates are comparable to 5-year rates.

- While Governing Counsel (ie. the Bank of Canada) is not eager to cut much further, we suspect that a combination of softer activity and milder core inflation trends will prompt additional action - BMO

- The BoC is keeping it powder dry while maintaining a bias toward easing - CIBC

- The latest upside inflation surprise means it could well now take downside economic growth surprises to justify further cuts - RBC

- Mortgage lenders well equipped to withstand current economic chaos - CMHC

- The vast majority of mortgage borrowers are taking fixed rates, but less than in 2024 - CMHC

- 79% of home buyers see it as a good long-term financial investment - CMHC

- 41% of new home buyers used down payment gift/inheritance - CMHC

- First-time home buyers could save up to $240 on their monthly mortgage payments due to the GST rebate, if they were to buy a home with an all-in, tax-included price of $1 million. The required down payment would also be somewhat smaller - Desjardins

- Canadian bank lending standards could tighten amid trade tensions - DBRS

- OSFI eyes loan-to-income rules to replace stress test as industry weighs implications - Canadian Mortgage Trends

- Canada's economic path now 'less treacherous' than previous months - RBC

- Nearly three quarters of impacted Canadian mortgage renewers plan to tighten pocketbooks to keep up with higher payments - TD

- 1.2 million Canadian mortgages are set to renew in 2025 - CBC

- Inflation in Canada slowed to 1.7% in April, but core inflation ticked up.

Housing Market

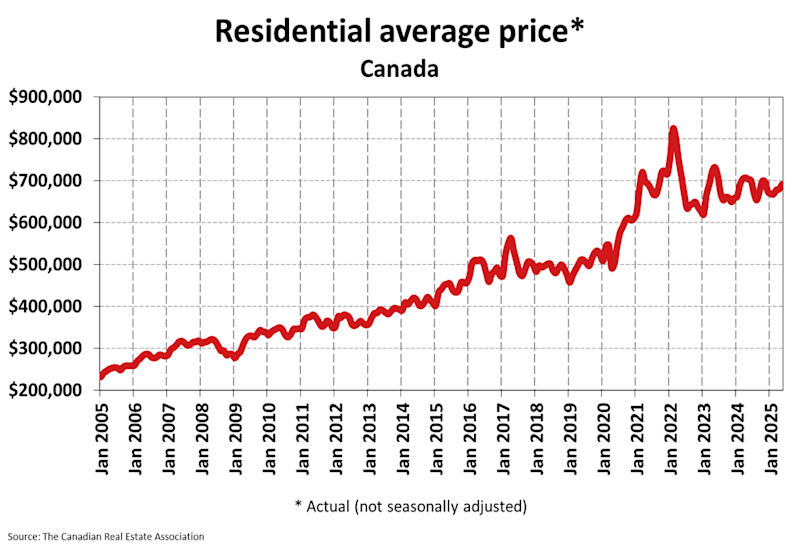

The MLS Home Price Index (HPI) declined slightly by 0.2% month-over-month in May 2025. The actual (not seasonally adjusted) national average sale price fell 1.8% year-over-year. The actual national average home price was $691,299 at the end of May 2025.

Housing Sales increased by 3.6% month-over-month in May 2025. Actual (not seasonally adjusted) sales were down 4.3% versus the prior year, May 2024.

Housing Market Headlines

- New listing activity in May increased 3.1% month-over-month - CREA

- Nationally, there were 4.9 months of housing inventory for sale at the end of May 2025, inline with the long-term average of 5 months - CREA

- May 2025 not only saw home sales move higher at the national level for the first time in more than six months, but prices at the national level also stopped falling - CREA

- It's only one month of data, and one car doesn't make a parade, but there is a sense that maybe the expected turnaround in housing activity this year was just delayed for a few months by the initial tariff chaos and uncertainty - CREA

- Housing markets are slowing across Canada, but that presents some of the best purchasing opportunities for buyers seen in decades - BMO

- Ottawa's GST rebate on new homes would save typical first-time buyer $27k - Parliamentary Budget Office

- Housing affordability continues to improve due to falling prices, rising wages and lower rates - National Bank

- Uncertainty in BC real estate market sees lowest home sales in a decade - Global News

- As inventory surges and prices stall, Vancouver homebuyers regain the upper hand - Real Estate Magazine

- Calgary home sales decline 22.4% year-over-year - CREB

- Most GTA residents say housing prices hamper business growth - Ipsos

- Most Toronto neighbourhoods are now in 'underbidding territory" - Wahi

- Ottawa home sales surge in May as buyers gaining confidence - OREB

- Maritime provinces top chart of best places to buy real estate in Canada - CTV News

- The current market can still provide opportunities for buyers who've saved for a down payment and are confident about their job security to enter the market, as there is a healthy selection of inventory to choose from with more favourable interest rates - TD

- A growing number of Canadians are pressing pause on homebuying plans as economic anxiety deepens - BMO

- Rising recession concerns among Canadians sidelining prospective homebuyers - BMO

- Housing starts held firm in May - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts