Monthly Market Update - September 15, 2023

Mortgage and housing markets are cooling due to higher rates.

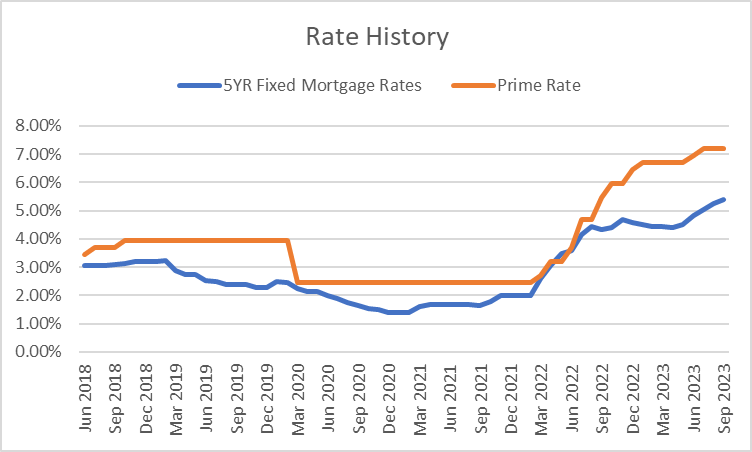

The Bank of Canada held rates unchanged at their scheduled announcement on September 6, but they left the door open to further increases. In the meantime, after increasing further in late August, bond market yields have moderated somewhat in the first half of September.

Housing sales declined in most markets. House prices have likewise declined in many markets. Inventory for sale has been increasing, indicating a return to a more balanced market.

Mortgage Market

- The prime rate remains at 7.20%

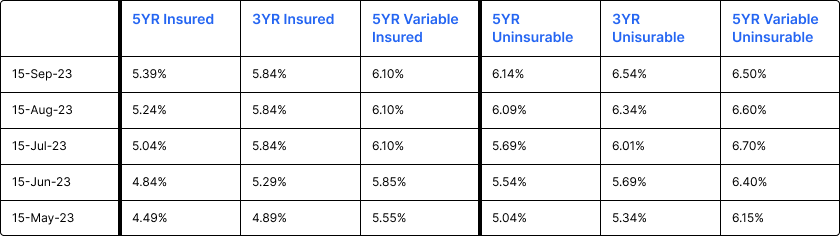

- Fixed mortgage rates rose again this past month, as shown below:

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates are higher in response to bond yields increasing in the latter half of August.

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- Canada has seen subprime become its fastest growing segment of borrowers - BetterDwelling

- Big banks reporting no areas of concern with mortgages renewing into higher rates so far in 2023

- Mortgage delinquencies are 32.6% higher than last year, but remain 36% lower than pre-pandemic levels - Equifax

- OSFI has expressed concern about variable-rate static-payment mortgages and is looking to curb their use. OSFI head, Peter Routledge recently said, “These borrowers are at risk of suffering a significant payment shock. While there are ways to reduce this shock—early voluntary paydowns and refinancing, to name a few—I think the housing finance system would produce better outcomes for borrowers and lenders alike if this product was less prevalent.”

- August inflation data will be released on Sept 19 and is expected to tick up to 3.7%.

Housing Market

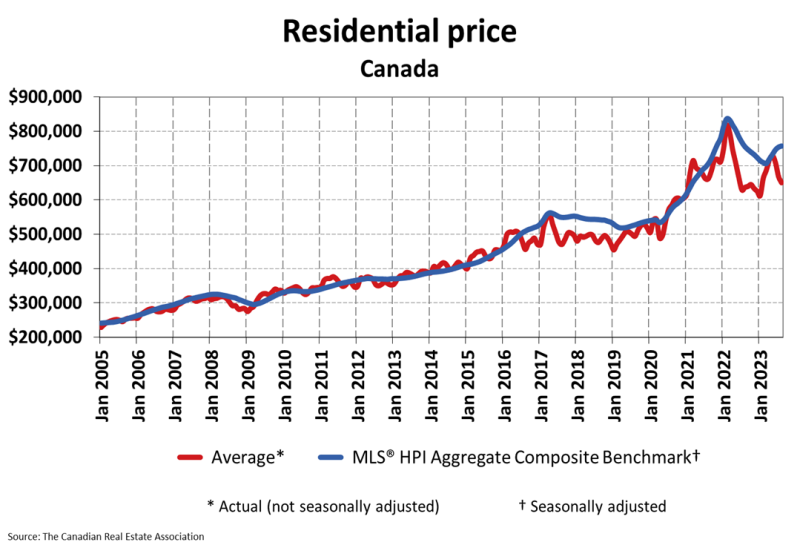

The MLS Home Price Index (HPI) was up 0.4% month-over-month in August 2023. The actual (not seasonally adjusted) national average sale price was also up 0.4% year-over-year.

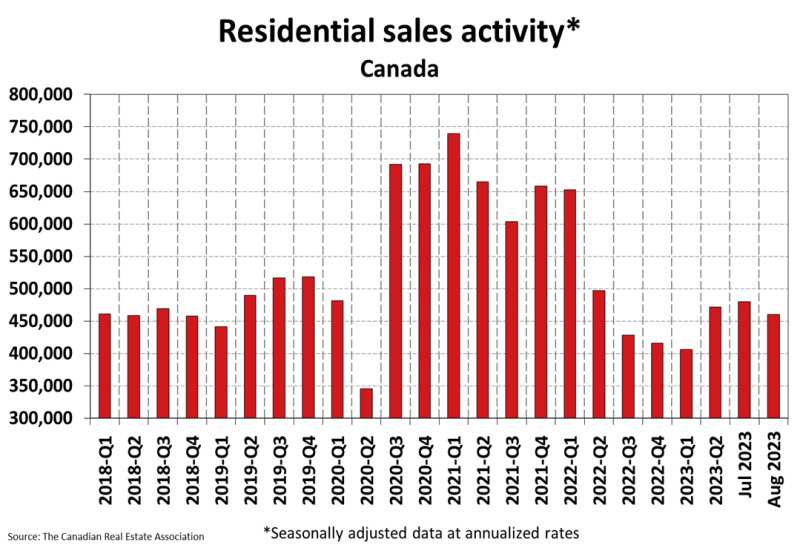

Housing Sales were down 4.1% month-over-month in August 2023. Actual (not seasonally adjusted) sales were up by 5.3% over the prior year, August 2022.

Housing Market Headlines

- New listing activity in August rose 0.8% month-over-month. This follows a cumulative gain in new listings of 24% between March and July - CREA

- National housing sales were pulled lower by declines in Greater Vancouver and the Fraser Valley, Montreal, Ottawa, Hamilton-Burlington and London-St. Thomas - CREA

- With the market coming into better balance, "this is giving buyers more time and more choice." - CREA

- Investors account for 30% of homebuying in Canada - Globe & Mail

- RE/MAX Canada anticipates a softening fall housing market for a majority of regions across the country, impacted equally by lack of inventory and the interest rate climate

- Canadians buying homes with family, friends to combat housing affordability woes - Royal LePage

- "Home prices are far too high" - Justin Trudeau. Why are our officials in Ottawa always the last to know?

- Fully 70% of Canadians said that they would be happy (40%) or somewhat happy (30%) to see home prices finally go down, according to a new poll conducted by Nanos Research for Bloomberg News.

- High interest rates, low appraisals are leading to a rise in distressed homebuyers who bought preconstruction suburban houses - Toronto Star

Do you have questions about getting a new mortgage or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts