Monthly Market Update - September 15, 2025

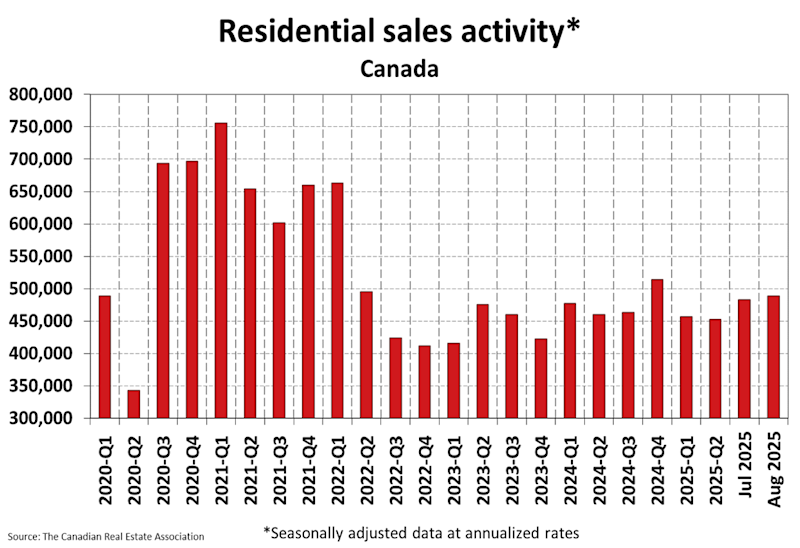

Optimism for a healthy fall housing market is on the rise. Sales have been increasing and we are seeing a higher number of inbound enquiries about mortgage financing. The market hopes to find a floor in prices, an increase in transaction activity and a return to more normalized conditions. With the odds of near term rate cuts increasing, perhaps we are nearing that possibility.

More homeowners are also looking for options at renewal and considering refinancing to try and optimize their financial situation. There are still pockets of stress, such as urban condo, but the financing market is picking up. This activity has prompted a few lenders to offer aggressive mortgage rates for the fall market and borrowers can take advantage, whether they be a new purchaser or a renewer/refinancer.

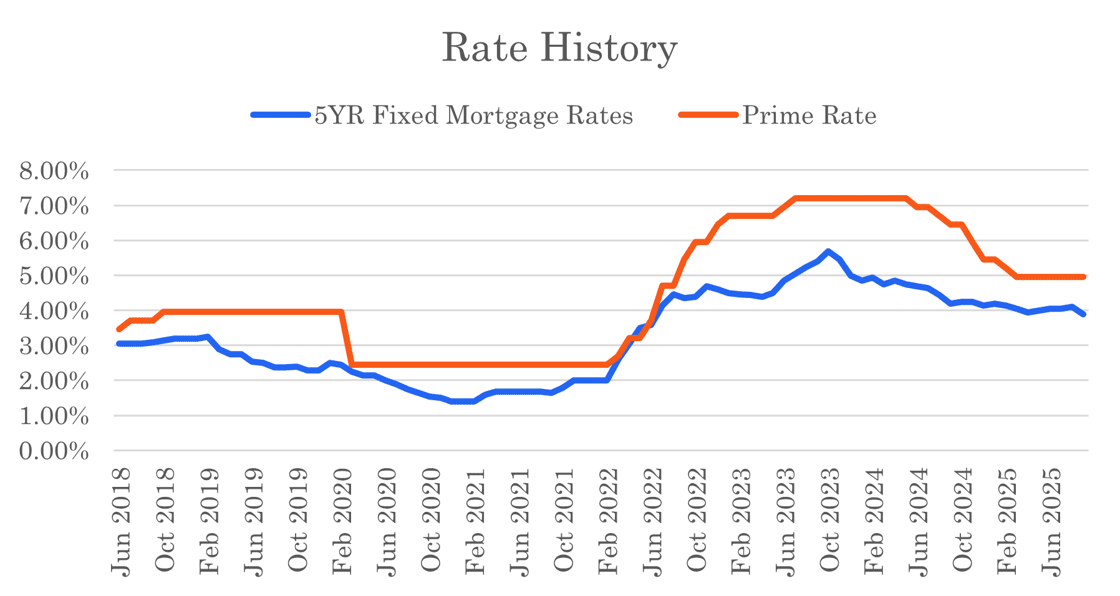

The Bank of Canada makes their next announcement on Wed Sept 17. With recent disappointing economic data, the expectations of a rate cut of 0.25% are high. Bank analysts now expect two 0.25% rate cuts before the end of the year.

Bond yields are down about 0.30% since this time last month. This has created the room for some lenders to lower their fixed mortgage rates. At Frank Mortgage, we now have rates as low at 3.69% for insured mortgages and uninsured mortgage rates have also dropped below 4% with one of our lenders.

Variable rates are a bit higher than fixed rates but should come down on Wednesday if the Bank of Canada cuts rates. Our best national insured, five-year, variable mortgage rate is currently 4.10%.

If you have a mortgage pre-approval you should benefit from this recent decline in rates. Check with your mortgage broker or lender to find out how you can do so before your mortgage closes.

Mortgage rates are changing quickly and a Bank of Canada cut will only add to this activity. Check with Frank Mortgage to find out where the best rates can be found to maximize your mortgage outcome, Get ahead of the anticipated active fall market and act now.

Housing sales rose again in August on a national level. The CREA says it recorded the most home sales in August in four years. Now with a few consecutive months of increasing sales there are strong signs of recovery and increased activity.

Mortgage Market

- The prime rate is 4.95% (if the Bank cuts by 0.25% this Wednesday, this rate will drop to 4.70%)

- The best nationally advertised mortgage rates are in the table below:

- The five year government bond yield is 2.68% today, 0.31% lower than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates remain steady but will drop upon the next Bank of Canada rate cut

- Fixed mortgage rates are lower with some lenders

- Short-term fixed mortgage rates (1 & 2-year rates) remain higher than 5-year mortgage rates. 3-year mortgage rates are now often better than 5-year rates.

- Most economists expect the Bank of Canada to cut its overnight rate by 25 bps on Sept 17 - Reuters

- Both central banks are expected to cut rates this week, but Canada's weaker economy gives the Bank of Canada more room to move than the US Federal Reserve - CIBC

- Lenders flip their calls to cuts after ugly jobs report - Canadian Mortgage Trends

- Borrowers gravitating toward fixed mortgage rates at renewal for peace of mind - MPA Mag

- Majority of Canadian homeowners are open to switching their lenders, refinancing at renewal time - Equifax

- 1.8 million mortgages are set to renew over the next 12 months - Bank of Canada

- Borrowers that locked in the lowest rates in 2020 and 2021 could see mortgage payments jump 20% upon renewal - Bank of Canada

- 8 in 10 Canadians say mortgage fraud creates an unfair housing market - MPC Survey

- Higher renewal costs testing household budgets in Ontario, B.C. - Equifax

- Significant increase in homeowner mortgage insurance demand in second quarter 2025 - CMHC

- Canadians considering switching banks and lenders to meet their credit and mortgage needs - Equifax

- Inflation in Canada eased to 1.7% in July. The August inflation report is due tomorrow, Sept 16.

Housing Market

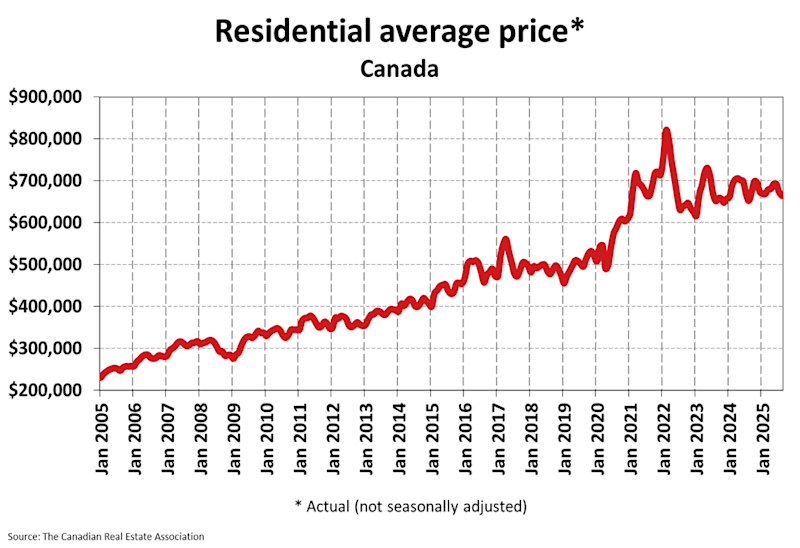

The MLS Home Price Index (HPI) was little changed (-0.1%) month-over-month in August 2025. The actual (not seasonally adjusted) national average sale price rose 1.8% year-over-year. The actual national average home price was $664,078 at the end of August 2025.

Housing Sales increased by 1.1% month-over-month in August 2025. Actual (not seasonally adjusted) sales were up 1.9% versus the prior year, August 2024.

Housing Market Headlines

- New listing activity was up in August by 2.6% month-over-month - CREA

- Nationally, there were 4.4 months of housing inventory for sale at the end of August 2025, below the long-term average of 5 months - CREA

- Activity has continued to gradually pick up steam over the last five months, but the experience from a year ago suggests that trend could accelerate this fall - CREA

- There is the potential that sales could really pick up in the next month or so depending on how many buyers are drawn off the sidelines, particularly if we see a September rate cut by the Bank of Canada - CREA

- The youngest age group of first-time homebuyers account for a large share of purchases in Ontario - Globe & Mail

- Younger Canadians are buying homes but overall credit market remains fragile - Wealth Professional

- 54% of Canadians believe that now is a good time to buy a home - RE/MAX

- Improved affordability, brought about by lower home prices and borrowing costs, is starting to translate into higher home sales - TRREB

- BC housing market shows signs of life but remains a buyer's market - Business Intelligence

- Vancouver home sales up almost 3% in August - GVR

- Calgary home sales down 9% in August - CREB

- Flood of new supply freezes Calgary home price growth - Real Estate Magazine

- Sask real estate market once again outperforming expectations - PA Now

- GTA home prices slip as listings outpace sales - TRREB

- Hamilton housing market sees modest recovery in August - Hamilton Spectator

- New Ottawa home sales reach five year high for July - Ottawa Business Journal

- Government aims to build 4,000 housing units on federal land

- OREA urges sweeping reforms to fix Ontario's rental market and boost housing supply - Canadian Mortgage Professional

- Rents fall across most major Canadian cities - RBC

- Slowdown in Toronto, Vancouver leaves national housing starts stats flat in first half of 2025 - CMHC

- Housing starts were up 4% in July - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts